Resolv Yield Distribution Parameter Update

Jan 12, 2026

Resolv is implementing an update to its yield distribution parameters, adjusting how daily income is allocated between the senior tranche (USR) and the junior tranche (RLP).

The update reflects a structurally safer and more diversified system, where counterparty concentration risk has declined materially. As a result, the risk premium required by junior capital is lower, allowing a greater share of yield to flow to the senior tranche.

Next Steps: Economics, Integrations, and the 2026 Outlook

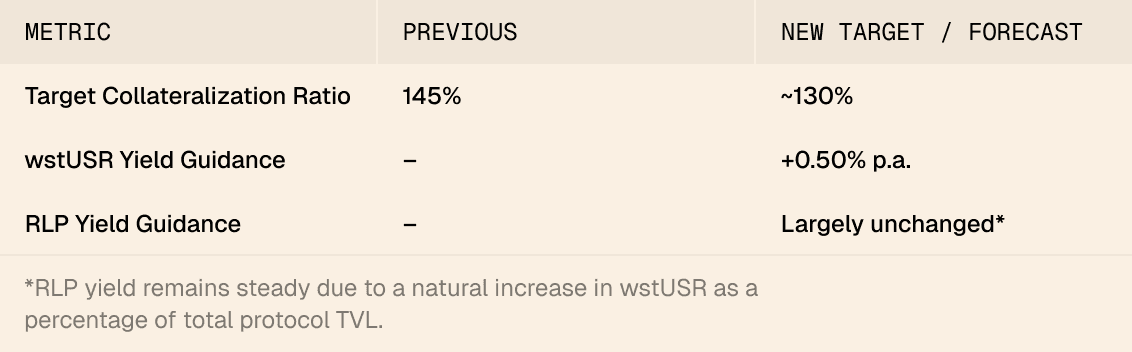

With the updated yield distribution, Resolv’s economics become better aligned with the current risk profile and structure of the protocol. Higher native yield improves the attractiveness of wstUSR across borrowing, vault, and structured-yield use cases, supporting the growth of the senior tranche as the core source of stable capital.

At the same time, RLP continues to function as the leveraged, junior-capital layer. While its relative share of protocol TVL is expected to normalize over time, it remains fully sufficient to absorb modeled stress scenarios and maintain system resilience.

This more balanced structure supports broader deployment of USR across integrations. As USR is integrated into prime lending venues, vaults, and DeFi money markets, capital productivity improves without increasing systemic risk.

The Updated Parameters:

Base Rate: 70% → 85%

Risk Premium: 30% → 15% Important note: this change is not expected to materially reduce RLP’s long-term yield.

Protocol Fee: Remains at 10%

💡 Refresher on Yield Distribution

Resolv distributes yield on a daily basis, after protocol fees, as follows:

A portion equal to the Base Rate is distributed pro rata to stUSR and RLP holders.

The Risk Premium accrues to RLP exclusively, reflecting its role as leveraged junior capital.

These adjustments move Resolv closer to an economically optimal equilibrium while maintaining the same level of modeled safety across all stress scenarios.

Where Resolv Is Today: Diversified, Stable, and Better Capitalized

When Resolv went live to the public in September 2024, its asset base consisted primarily of concentrated futures positions on leading exchanges to hedge ETH collateral.

Just over a year later, the protocol operates with materially greater diversification and structural safety.

Credit Risk

With the implementation of the Resolv Asset Cluster Architecture, collateral now spans across:

Fragmented inventory positions in ETH, BTC, and major altcoins;

Futures positions at four centralized and decentralized exchange venues;

Leading ETH and BTC liquid staking token products;

Low-risk, principal-protected positions on prime lending protocols;

RWA Cluster with leveraged positions at the Aave Horizon instance.

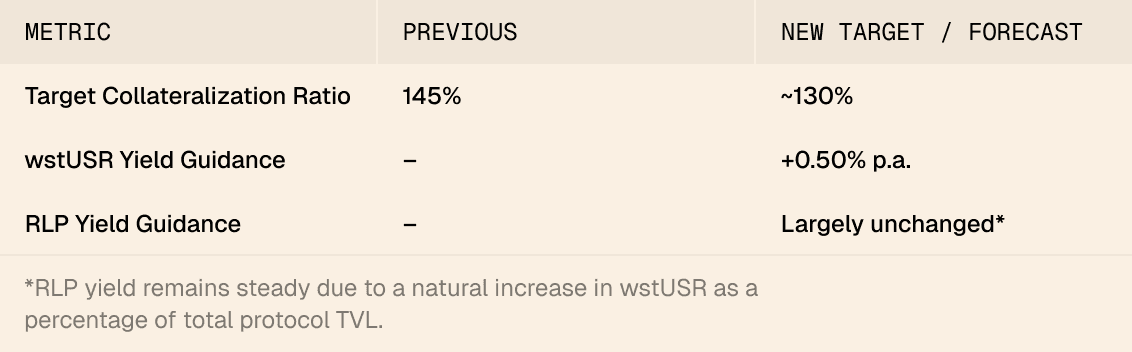

This evolution reduces the amount of junior capital required to absorb drawdowns, especially as Resolv transitions into a fractional-reserve model designed for institutional scale.

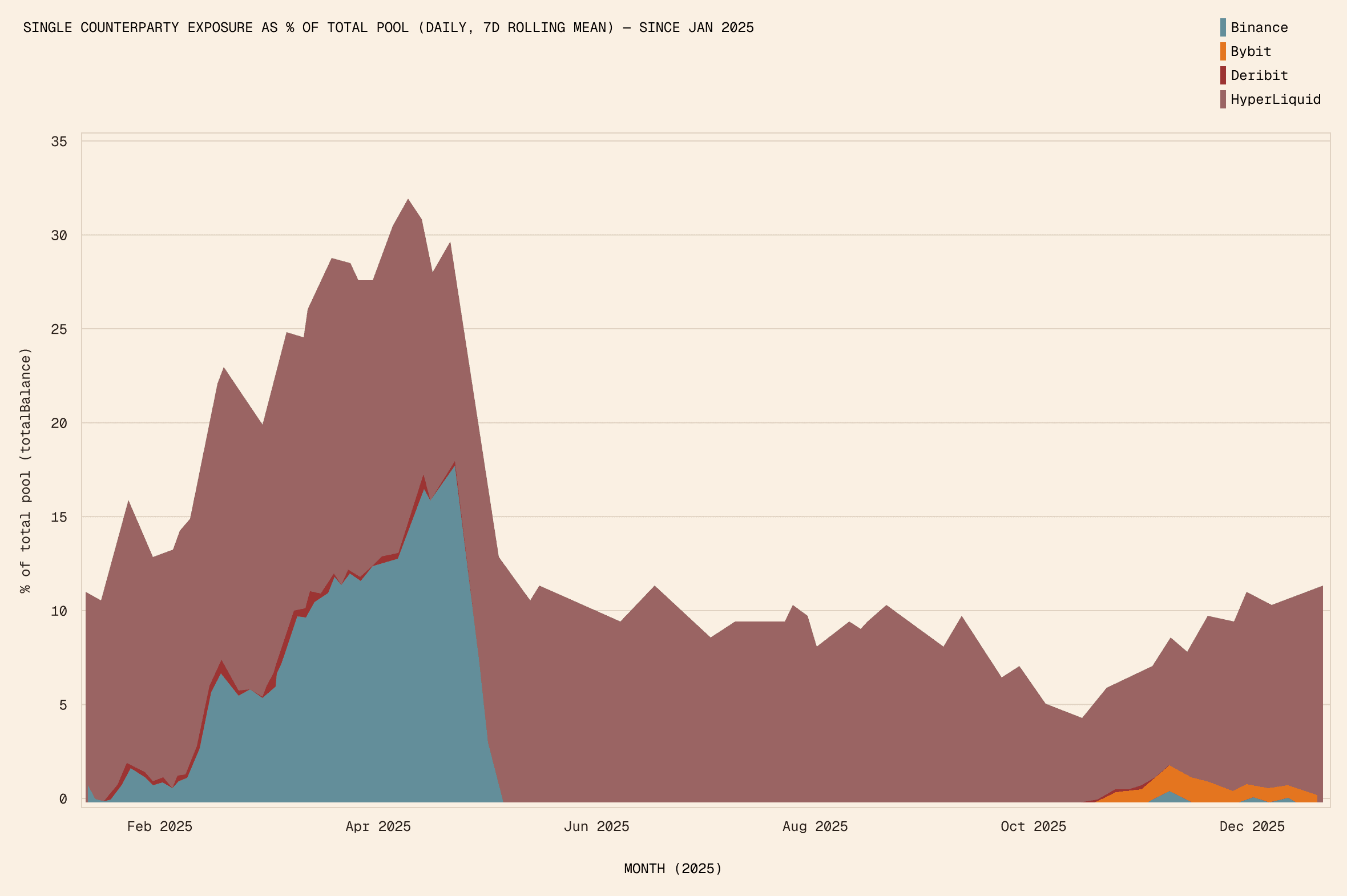

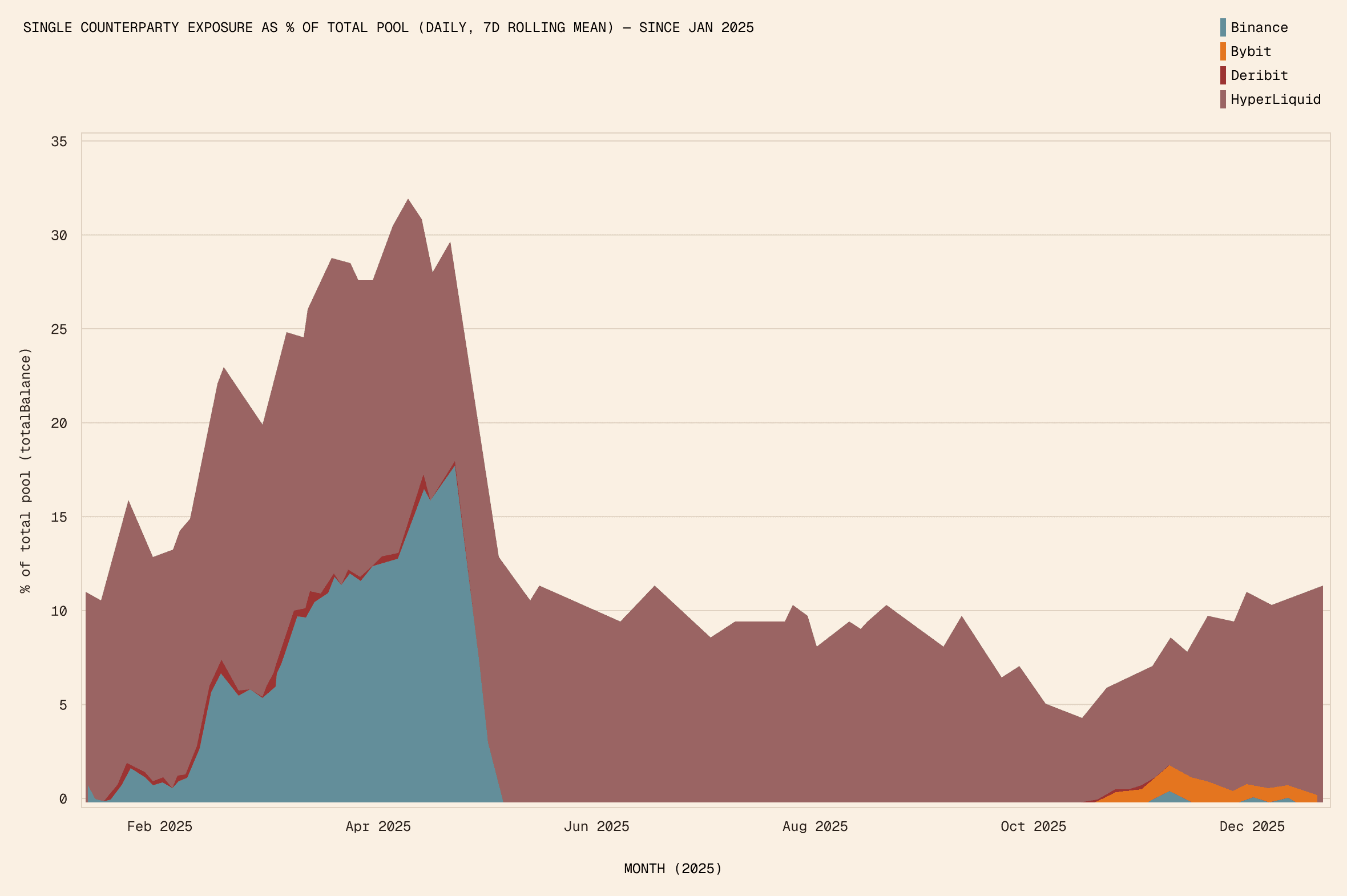

As shown on the chart below, over the course of second half of 2025, exchange-related positions have steadily contributed to less than 15% of the collateral pool exposure, combined.

Exposure to DeFi lending protocols is not shown in this chart, as these integrations operate on a pass-through basis: lending is collateralized directly by Aave and Fluid’s diversified collateral base, with moderate counterparty concentration.

Market Risk

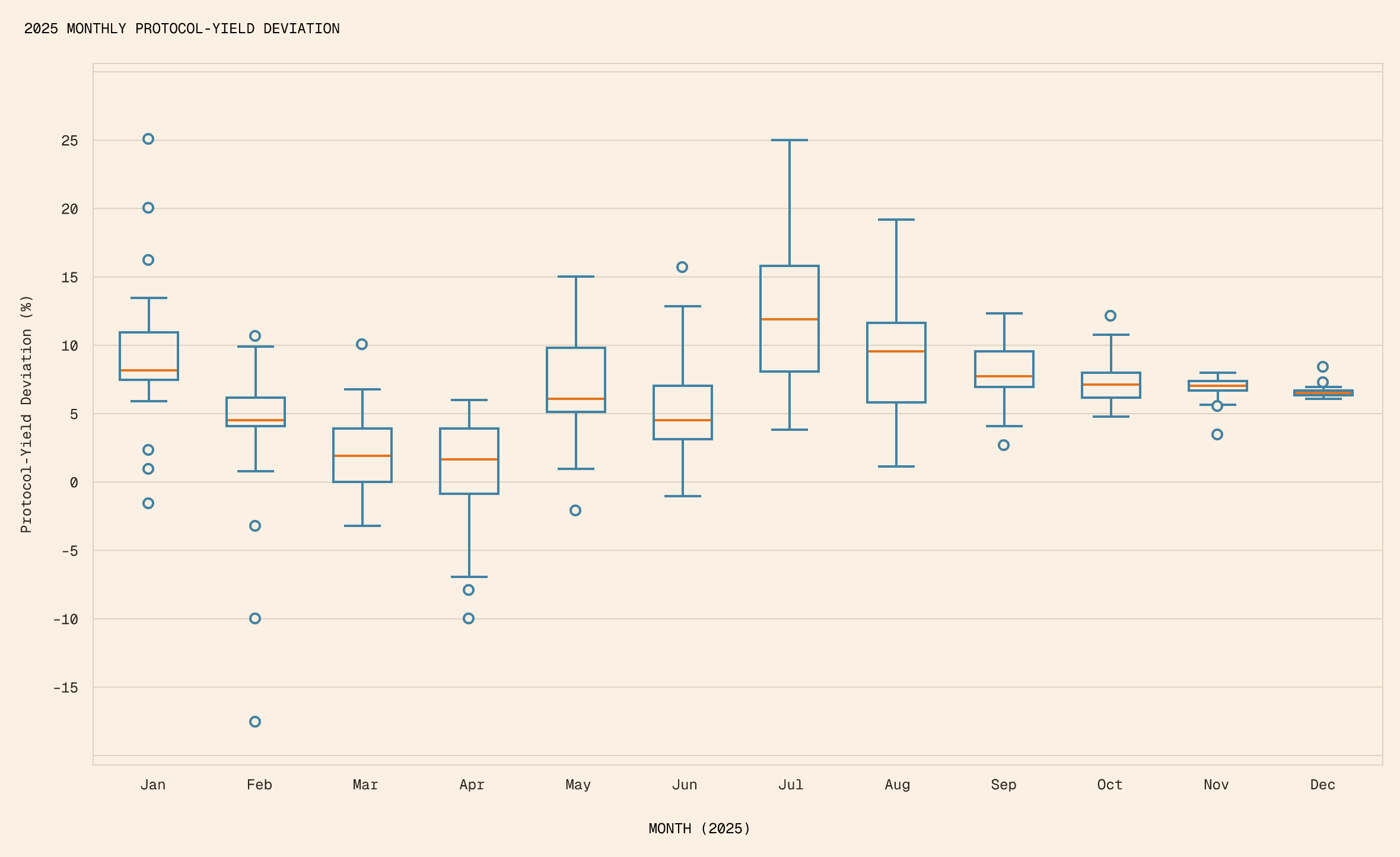

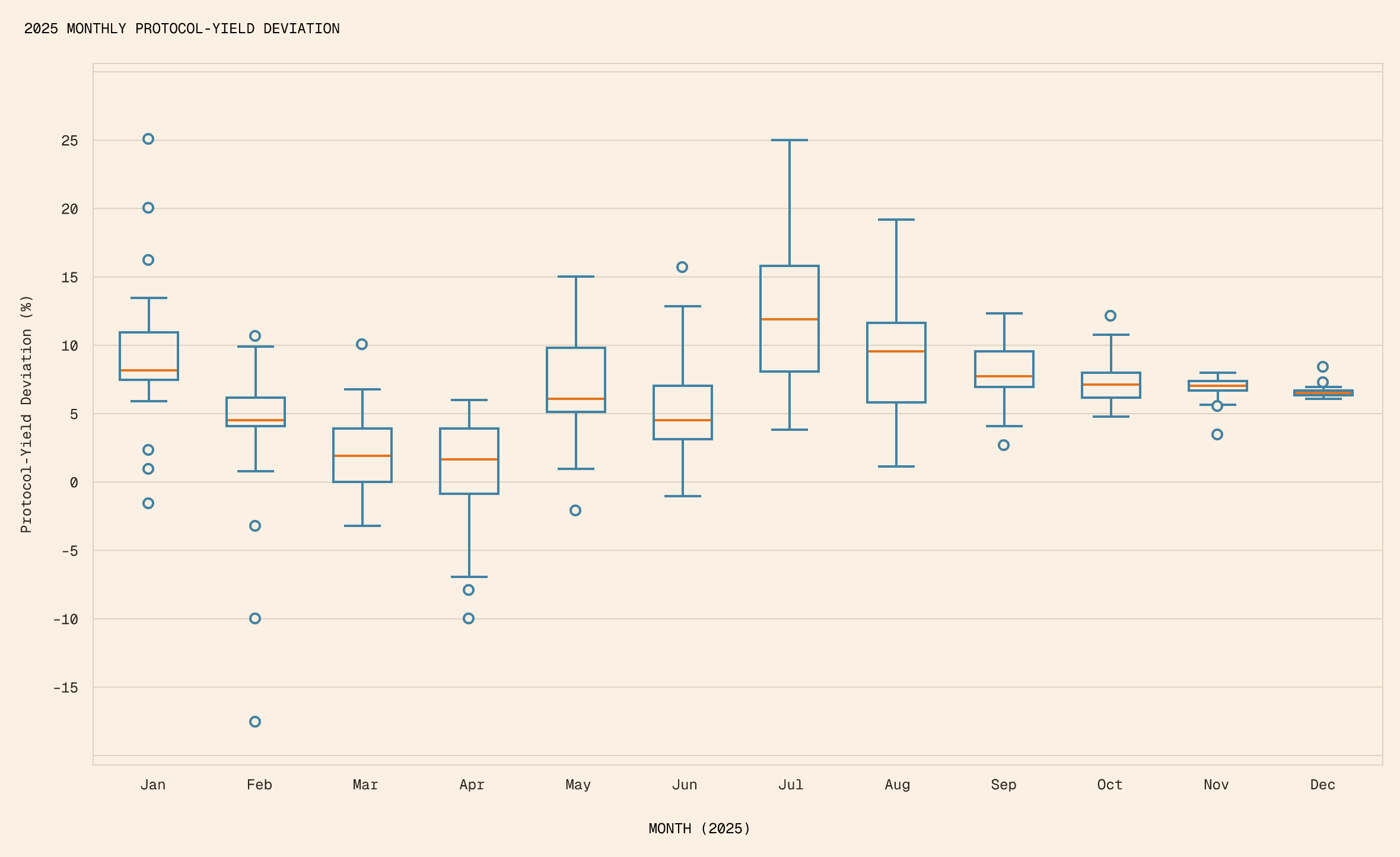

Market risk levels have steadily declined. Protocol yield volatility remains low and stable across varying market regimes, confirmed by ongoing internal risk monitoring.

The system today is simply more diversified and predictable than it was at launch.

Why Capital Efficiency Matters

For any financial system with senior and junior tranches of capital, such as banks or structured finance vehicles, capital structure defines both safety and the ability to scale.

There is a direct connection between senior and junior tranches regarding cost of capital and the asset base:

When risk grows faster than capital: Senior tranches require higher yield, and the system must attract more junior capital to absorb potential losses.

When the system is overcapitalized: Senior liabilities become "too cheap" (yields are too low), depressing returns and limiting balance-sheet utilization.

Resolv today is closer to the second category.

Observable market dynamics highlight that:

RLP captures a disproportionately large share of protocol yield, signaling a surplus of junior capital.

Senior tranche (USR) currently receive yields below what the protocol can sustainably deliver, making USR less economically expressive than it could be.

Increasing the Base Rate and reducing the Risk Premium addresses this imbalance directly.

Senior tranche (USR) receive stronger, more competitive native yield.

Junior capital (RLP) remains sufficient to absorb modeled tail-risk events.

The overall system moves toward a healthier long-term equilibrium.

This shift does not reduce safety. Instead, it brings Resolv’s structure closer to global prudential norms for fractional-reserve, yield-bearing financial products.

Parameter Change & Implementation Plan

Implementation Timeline

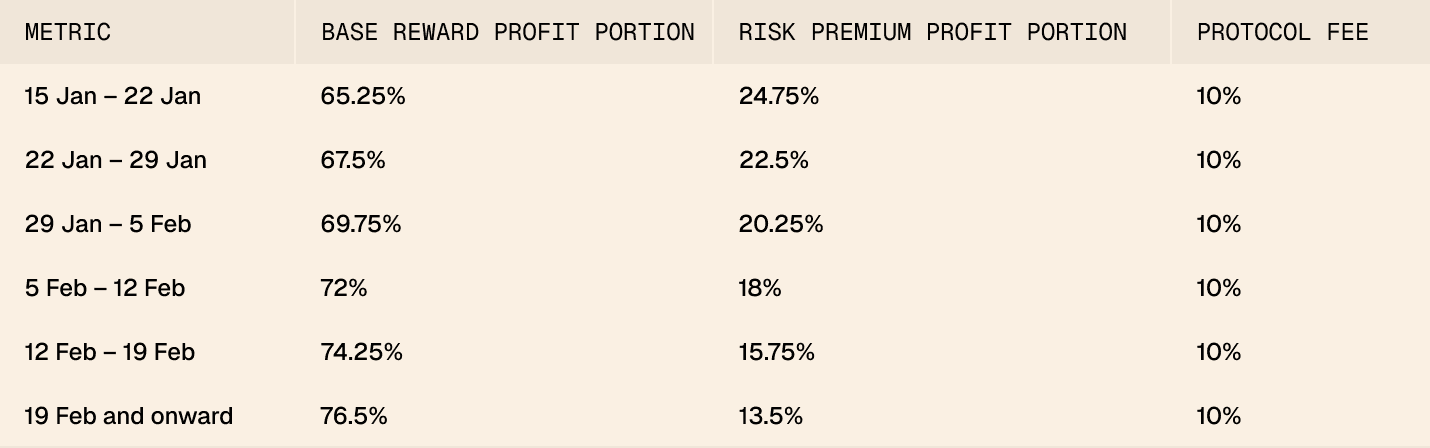

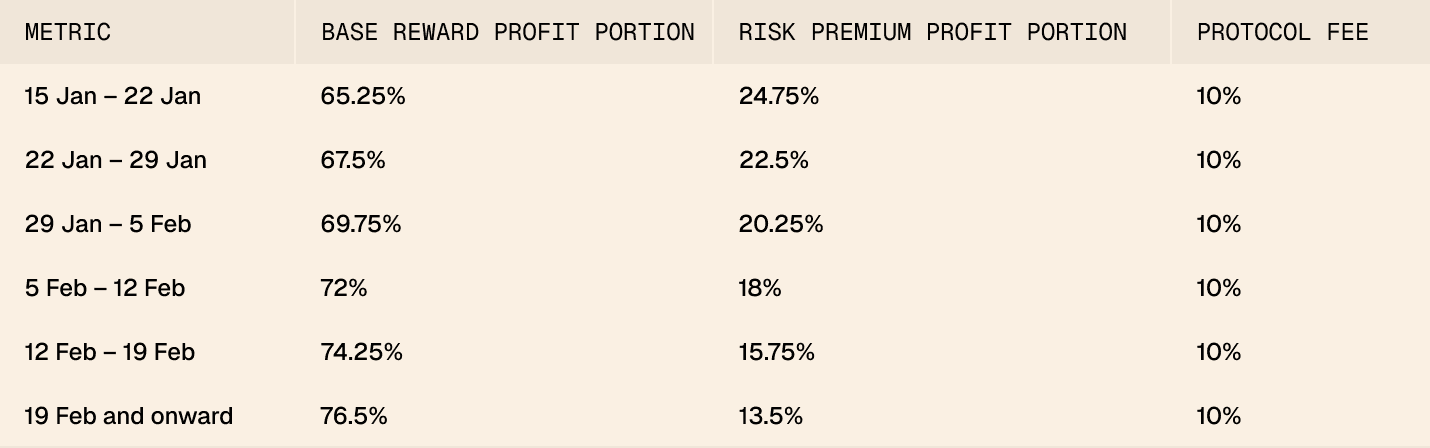

The update will be introduced gradually across six weekly increments between 15 January and 19 February, allowing yields to adjust smoothly.

Effective 19 February, the parameters will reach the stable state:

Base Rate: 85%

Risk Premium: 15%

Taking the protocol fee into account, the resulting distribution is:

Note: The update applies automatically to all positions. No unstaking, migration, or actions are required.

Expected Long-Term Outcomes

While the Risk Premium is reduced at the protocol level, the expected yield for RLP holders remains broadly stable.

This is because the junior layer becomes thinner over time as the system moves toward a more efficient capital structure. In practice, this means:

The risk premium is distributed across a smaller share of total capital

Each unit of RLP continues to capture a comparable portion of excess yield

Risk Validation

These changes were validated using a methodology based on Basel III prudential regulations, specifically analyzing:

Credit risk of derivative positions (the futures component of the delta-neutral portfolio).

Credit risk of collateralized lending positions, where eligible collateral offsets exposure.

This procedure marks the beginning of planned risk framework improvements geared toward compatibility with global prudential regulation.

Next Steps: Economics, Integrations, and the 2026 Outlook

Strengthening USR Economics

The higher Base Rate supports growth of the senior tranche as the primary source of stable capital, especially across money markets and institutional vaults.

Continuing the Role of RLP

RLP will remain the leveraged, junior-capital layer. Its relative size is expected to shift toward a healthier long-term band while remaining fully sufficient for risk absorption responsibilities.

Expanding Integrations

In 2026, Resolv will continue scaling USR across institutional-grade integrations, building on existing deployments with Lido, Ether.fi. Upcoming focus areas include:

deeper integrations with prime lending markets,

and deployment into new DeFi money markets where stable, risk-optimized yield is required.

Resolv is implementing an update to its yield distribution parameters, adjusting how daily income is allocated between the senior tranche (USR) and the junior tranche (RLP).

The update reflects a structurally safer and more diversified system, where counterparty concentration risk has declined materially. As a result, the risk premium required by junior capital is lower, allowing a greater share of yield to flow to the senior tranche.

Next Steps: Economics, Integrations, and the 2026 Outlook

With the updated yield distribution, Resolv’s economics become better aligned with the current risk profile and structure of the protocol. Higher native yield improves the attractiveness of wstUSR across borrowing, vault, and structured-yield use cases, supporting the growth of the senior tranche as the core source of stable capital.

At the same time, RLP continues to function as the leveraged, junior-capital layer. While its relative share of protocol TVL is expected to normalize over time, it remains fully sufficient to absorb modeled stress scenarios and maintain system resilience.

This more balanced structure supports broader deployment of USR across integrations. As USR is integrated into prime lending venues, vaults, and DeFi money markets, capital productivity improves without increasing systemic risk.

The Updated Parameters:

Base Rate: 70% → 85%

Risk Premium: 30% → 15% Important note: this change is not expected to materially reduce RLP’s long-term yield.

Protocol Fee: Remains at 10%

💡 Refresher on Yield Distribution

Resolv distributes yield on a daily basis, after protocol fees, as follows:

A portion equal to the Base Rate is distributed pro rata to stUSR and RLP holders.

The Risk Premium accrues to RLP exclusively, reflecting its role as leveraged junior capital.

These adjustments move Resolv closer to an economically optimal equilibrium while maintaining the same level of modeled safety across all stress scenarios.

Where Resolv Is Today: Diversified, Stable, and Better Capitalized

When Resolv went live to the public in September 2024, its asset base consisted primarily of concentrated futures positions on leading exchanges to hedge ETH collateral.

Just over a year later, the protocol operates with materially greater diversification and structural safety.

Credit Risk

With the implementation of the Resolv Asset Cluster Architecture, collateral now spans across:

Fragmented inventory positions in ETH, BTC, and major altcoins;

Futures positions at four centralized and decentralized exchange venues;

Leading ETH and BTC liquid staking token products;

Low-risk, principal-protected positions on prime lending protocols;

RWA Cluster with leveraged positions at the Aave Horizon instance.

This evolution reduces the amount of junior capital required to absorb drawdowns, especially as Resolv transitions into a fractional-reserve model designed for institutional scale.

As shown on the chart below, over the course of second half of 2025, exchange-related positions have steadily contributed to less than 15% of the collateral pool exposure, combined.

Exposure to DeFi lending protocols is not shown in this chart, as these integrations operate on a pass-through basis: lending is collateralized directly by Aave and Fluid’s diversified collateral base, with moderate counterparty concentration.

Market Risk

Market risk levels have steadily declined. Protocol yield volatility remains low and stable across varying market regimes, confirmed by ongoing internal risk monitoring.

The system today is simply more diversified and predictable than it was at launch.

Why Capital Efficiency Matters

For any financial system with senior and junior tranches of capital, such as banks or structured finance vehicles, capital structure defines both safety and the ability to scale.

There is a direct connection between senior and junior tranches regarding cost of capital and the asset base:

When risk grows faster than capital: Senior tranches require higher yield, and the system must attract more junior capital to absorb potential losses.

When the system is overcapitalized: Senior liabilities become "too cheap" (yields are too low), depressing returns and limiting balance-sheet utilization.

Resolv today is closer to the second category.

Observable market dynamics highlight that:

RLP captures a disproportionately large share of protocol yield, signaling a surplus of junior capital.

Senior tranche (USR) currently receive yields below what the protocol can sustainably deliver, making USR less economically expressive than it could be.

Increasing the Base Rate and reducing the Risk Premium addresses this imbalance directly.

Senior tranche (USR) receive stronger, more competitive native yield.

Junior capital (RLP) remains sufficient to absorb modeled tail-risk events.

The overall system moves toward a healthier long-term equilibrium.

This shift does not reduce safety. Instead, it brings Resolv’s structure closer to global prudential norms for fractional-reserve, yield-bearing financial products.

Parameter Change & Implementation Plan

Implementation Timeline

The update will be introduced gradually across six weekly increments between 15 January and 19 February, allowing yields to adjust smoothly.

Effective 19 February, the parameters will reach the stable state:

Base Rate: 85%

Risk Premium: 15%

Taking the protocol fee into account, the resulting distribution is:

Note: The update applies automatically to all positions. No unstaking, migration, or actions are required.

Expected Long-Term Outcomes

While the Risk Premium is reduced at the protocol level, the expected yield for RLP holders remains broadly stable.

This is because the junior layer becomes thinner over time as the system moves toward a more efficient capital structure. In practice, this means:

The risk premium is distributed across a smaller share of total capital

Each unit of RLP continues to capture a comparable portion of excess yield

Risk Validation

These changes were validated using a methodology based on Basel III prudential regulations, specifically analyzing:

Credit risk of derivative positions (the futures component of the delta-neutral portfolio).

Credit risk of collateralized lending positions, where eligible collateral offsets exposure.

This procedure marks the beginning of planned risk framework improvements geared toward compatibility with global prudential regulation.

Next Steps: Economics, Integrations, and the 2026 Outlook

Strengthening USR Economics

The higher Base Rate supports growth of the senior tranche as the primary source of stable capital, especially across money markets and institutional vaults.

Continuing the Role of RLP

RLP will remain the leveraged, junior-capital layer. Its relative size is expected to shift toward a healthier long-term band while remaining fully sufficient for risk absorption responsibilities.

Expanding Integrations

In 2026, Resolv will continue scaling USR across institutional-grade integrations, building on existing deployments with Lido, Ether.fi. Upcoming focus areas include:

deeper integrations with prime lending markets,

and deployment into new DeFi money markets where stable, risk-optimized yield is required.