Resolv Expands Into Altcoin Money Markets

Dec 23, 2025

Resolv is adding a new yield source by connecting to altcoin markets, starting with HYPE and SOL. These positions are fully hedged using futures on Binance and Hyperliquid, keeping the system delta-neutral while accessing attractive funding and staking rewards available in altcoin ecosystems.

With expected neutral yields in the 10–15% range and moderate allocation not exceeding 10% of the collateral pool, this integration is expected to increase overall returns by approximately 5–10%, depending on market conditions.

This expands Resolv’s coverage of the crypto yield landscape and improves integration with fast-growing ecosystems, without changing the protocol’s risk discipline: USR remains a stable, conservative product, and RLP continues to take leveraged exposure in exchange for higher returns.

State of altcoin money markets

Over the past year, native staking and liquid staking tokens (LSTs) in altcoin ecosystems have truly taken off. Across Solana and Hyperliquid, the LSTs are forming approximately 50% of total value in DeFi.

Additionally, non-DeFi assets like XRP are increasingly being reinvested into DeFi to gain utility yields. This restaking trend is turning altcoin ecosystems into fertile ground for stable, neutral-yield opportunities.

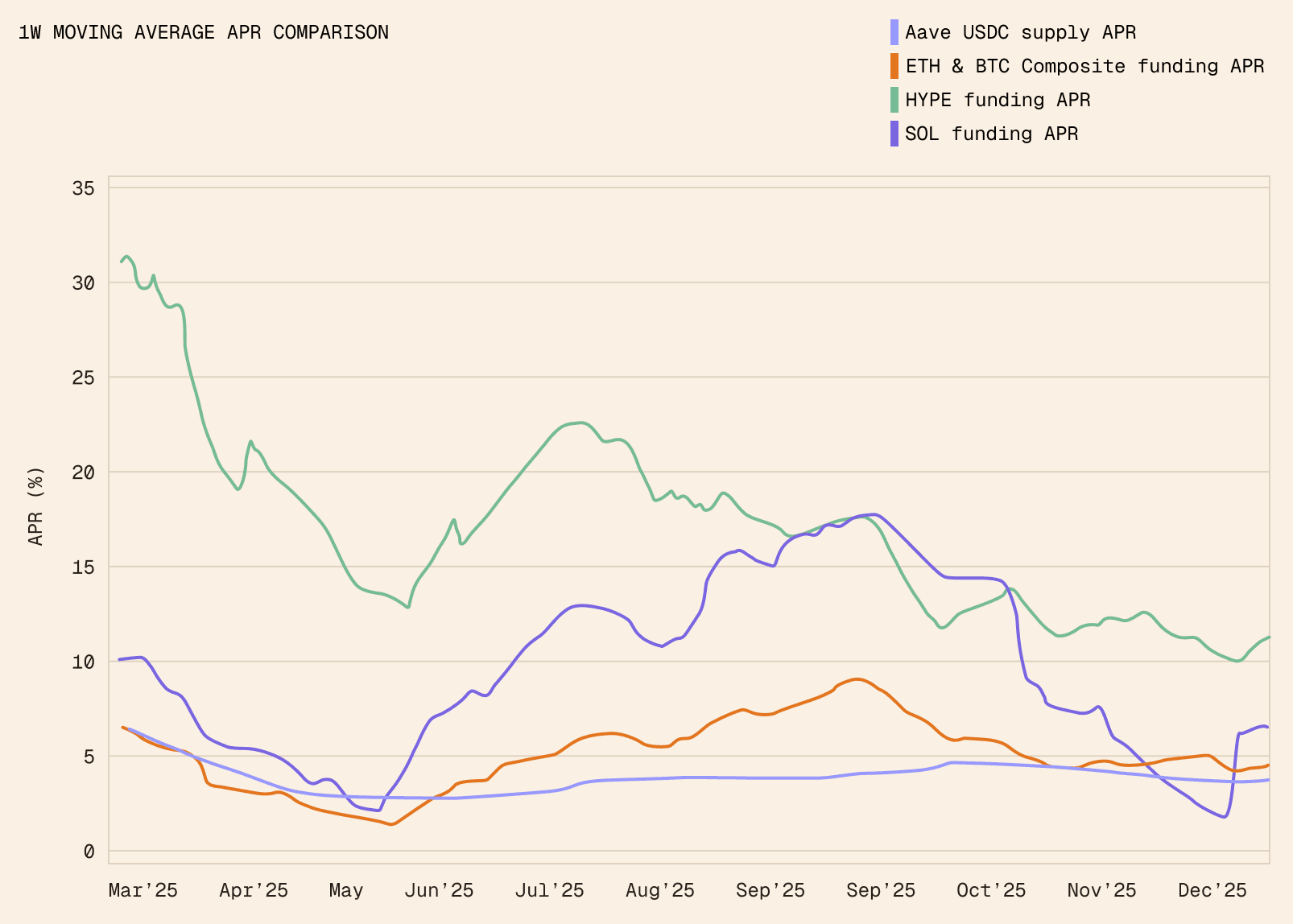

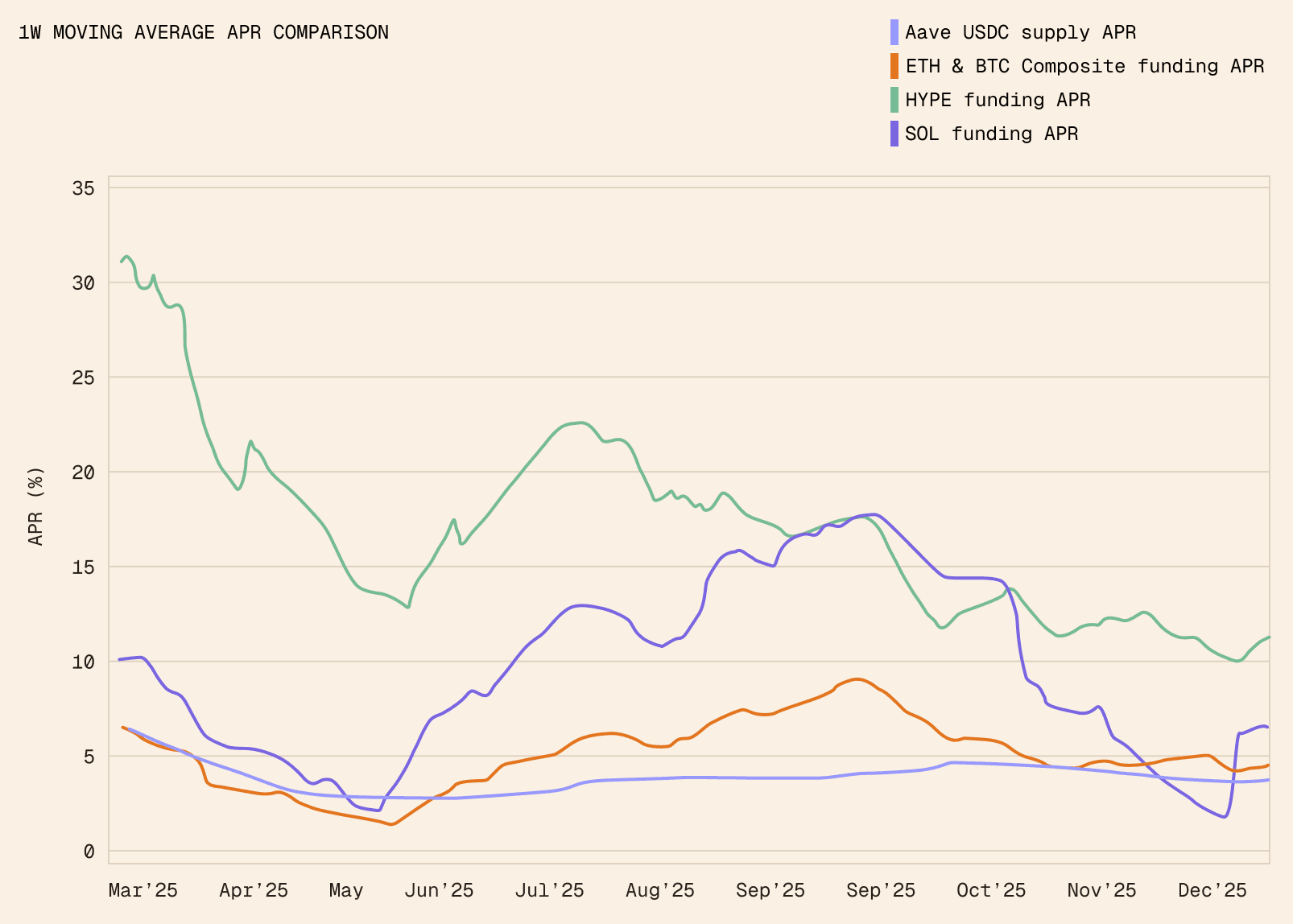

We are also witnessing deeper funding rates on altcoin futures and greater accessibility to these markets for professional trading firms and funds. In other words, altcoin money markets are no longer niche or speculative. They are becoming a structured, narrative-driven segment of the market that can be tapped for stable returns.

Launching the Altcoin Cluster: HYPE and SOL as Initial Assets

Resolv is now connected to altcoin markets through a dedicated delta-neutral cluster.

The first assets in scope:

HYPE

SOL

Selection criteria were practical: competitive performance, liquidity depth on derivative markets, available staking infrastructure, vast ecosystem. Hedging and position management will run on:

Hyperliquid

Binance

Both venues offer the liquidity required for tight hedges and predictable funding capture. The cluster runs fully hedged and conservatively collateralized, same as for ETH and BTC positions.

Strategic Capabilities Enabled

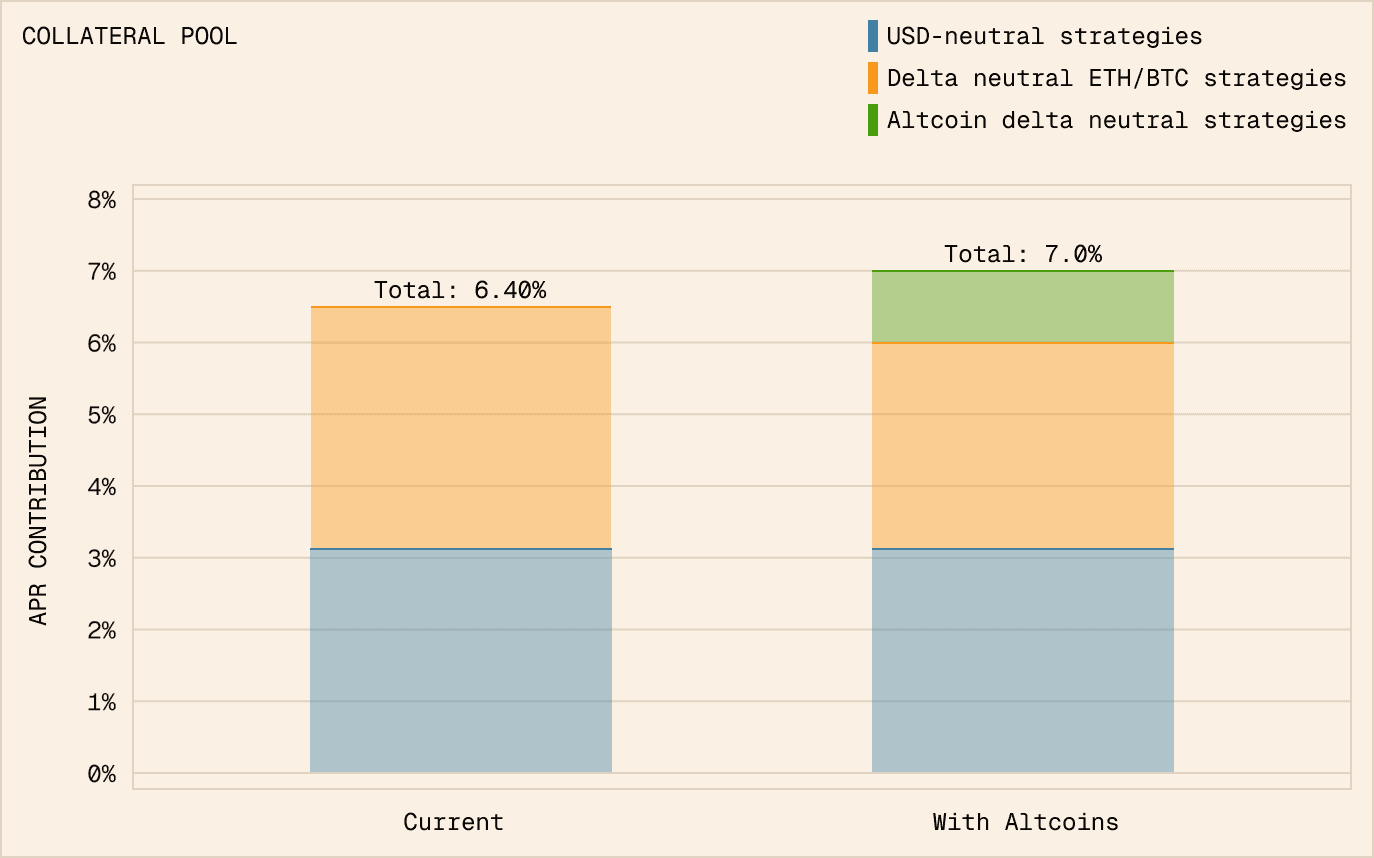

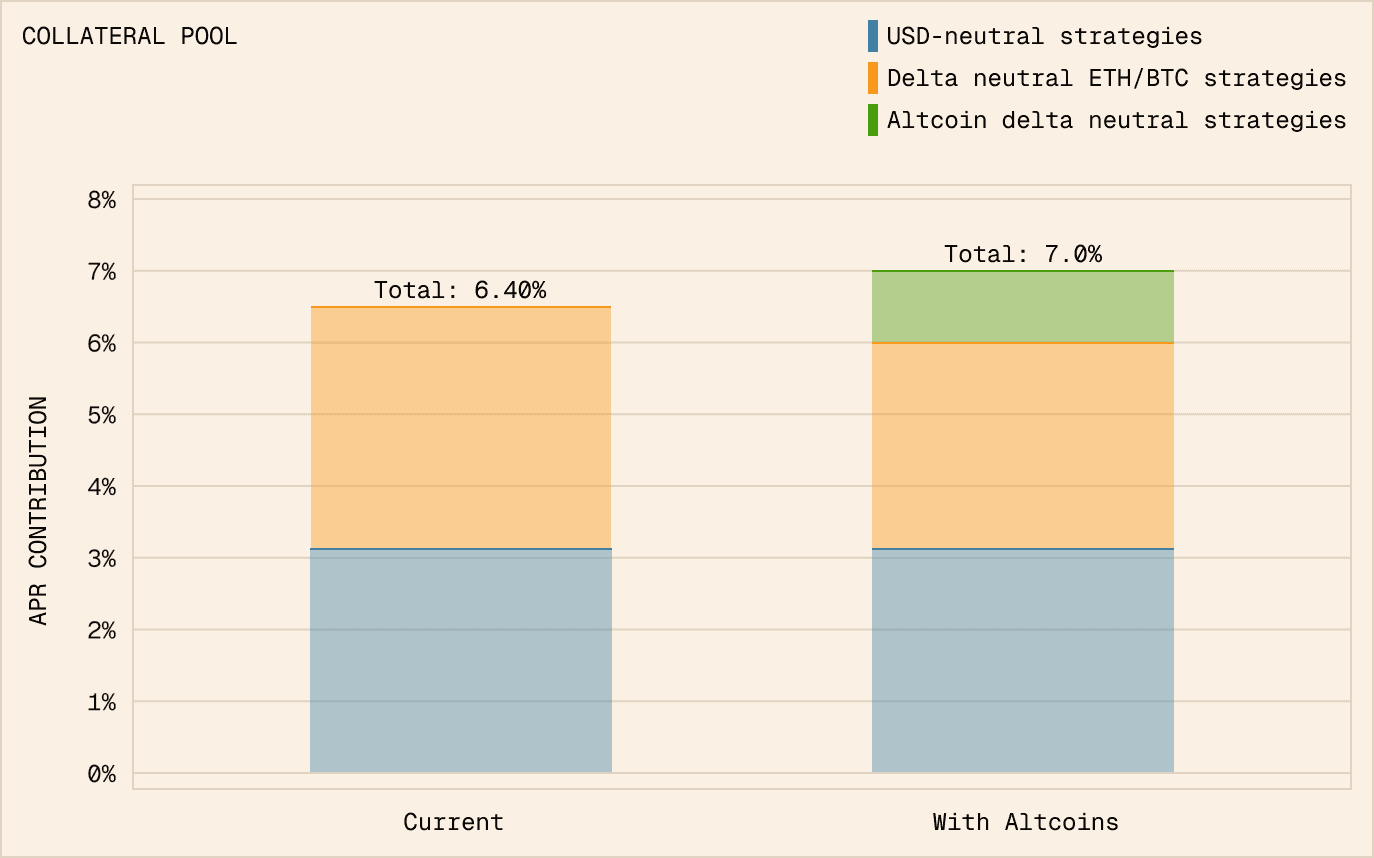

~0.6% increase of the collateral pool APR with a 10% allocation to the Altcoin Cluster.

Accessing Bullish Altcoin Money Markets

Altcoin funding markets frequently experience yield spikes driven by narratives, network launches, TGEs, or ecosystem-specific events. These create pockets of elevated funding rates that are ideal for delta-neutral strategies.

Resolv can now systematically capture and commoditize these event-driven yield opportunities and pass them through to users — without taking directional risk.

Partnerships Around Native Staking & Altcoin LSTs

Many ecosystems need reliable, hedged demand for their staked assets. The Altcoin Cluster allows Resolv to act as an infrastructure-level allocator for these networks.

It also enables new integrations with:

staking providers

altcoin LST products

ecosystem treasury tools

In practice, Resolv provides a way to stablecoinize altcoin staking yield, turning volatile native token flows into stable, risk-adjusted yield streams. This expands utility for altcoin ecosystems and broadens their integration surface.

Deeper Alignment With Fast-Growing Ecosystems

By deploying hedged assets into staking and providing liquidity to relevant markets, Resolv contributes to altcoin markets in a measurable way.

More importantly, this expands Resolv’s integration roadmap:

Resolv is already live on HyperEVM and HyperCore.

Future integrations in our roadmap include networks such as Solana, AVAX, and others where native assets can be invested through delta-neutral mechanisms.

Over time, this creates a holistic loop: ecosystems gain access to a stablecoin that invests in their assets, strengthening both sides.

Resolv’s presence becomes embedded, not external.

Strengthened Risk Management

The altcoin expansion builds on an upgraded risk framework introduced after the 10 October event, when markets experienced broad, synchronized liquidations.

For the altcoin cluster, Resolv implemented:

Volatility-responsive margin thresholds (more conservative than ETH/BTC).

ADL mitigation mechanisms to reduce exposure to forced deleveraging cascades.

These updates make the system more resilient to the higher variance and sudden price dislocations typical of altcoin markets.

Expected Impact on Yield & Allocation Approach

1. Allocation

Initial allocation capped at 10%.

Scale-up will occur only after observing stable cluster behavior and venue liquidity.

This communicates a clear allocation guideline and demonstrates that Resolv is not taking aggressive positioning.

2. Expected Performance Impact

Historically, altcoin delta-neutral yields (funding + staking) have ranged between 10–15%.

This expansion diversifies yield sources and strengthens the core product without materially increasing the system’s risk surface. RLP continues to absorb first-loss risk as designed, allowing USR to maintain its high-confidence stability profile.

Closing the 2025 Product Cycle

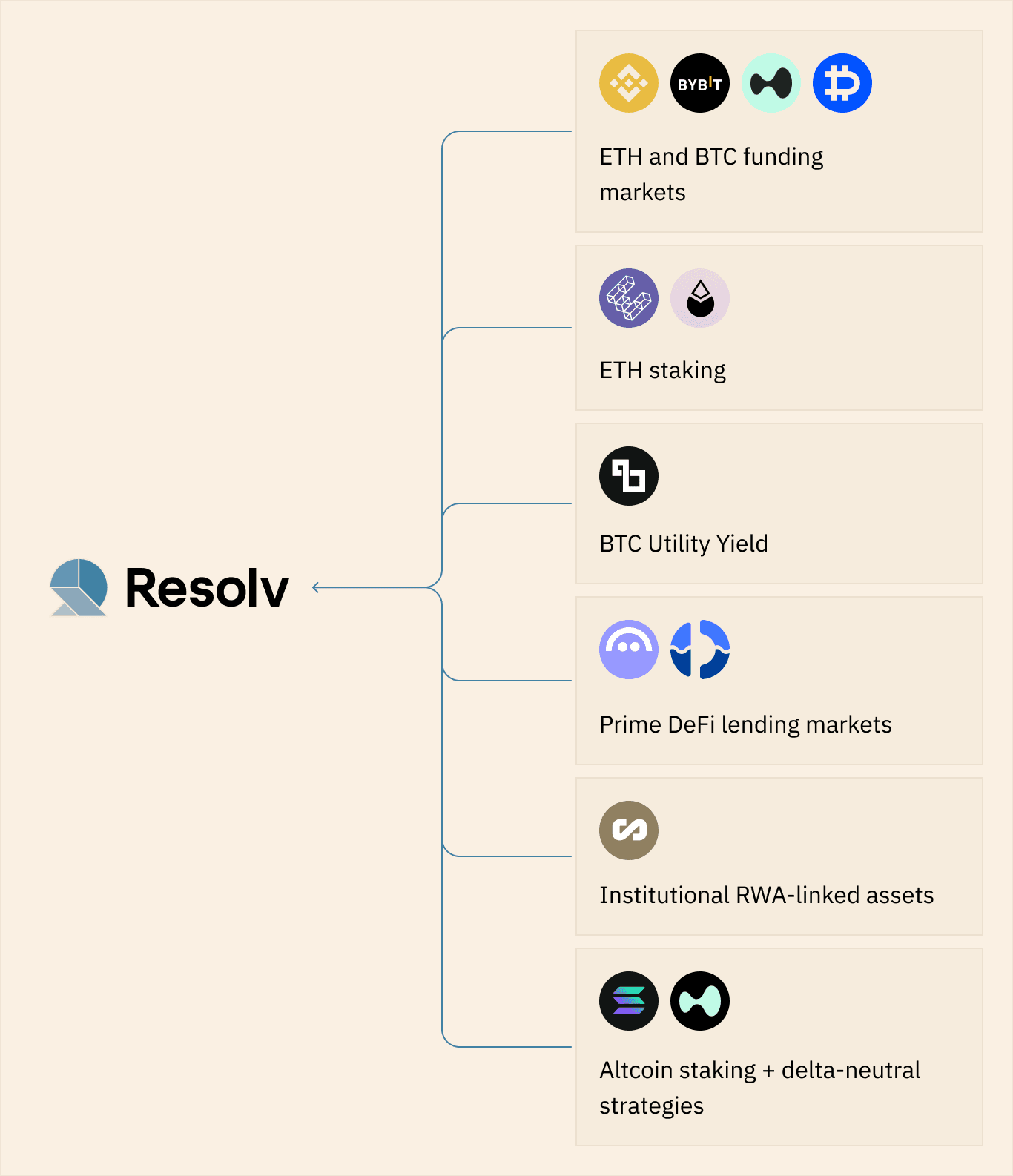

With the Altcoin Cluster release, Resolv completes its 2025 development cycle and enters 2026 with a fully diversified yield engine.

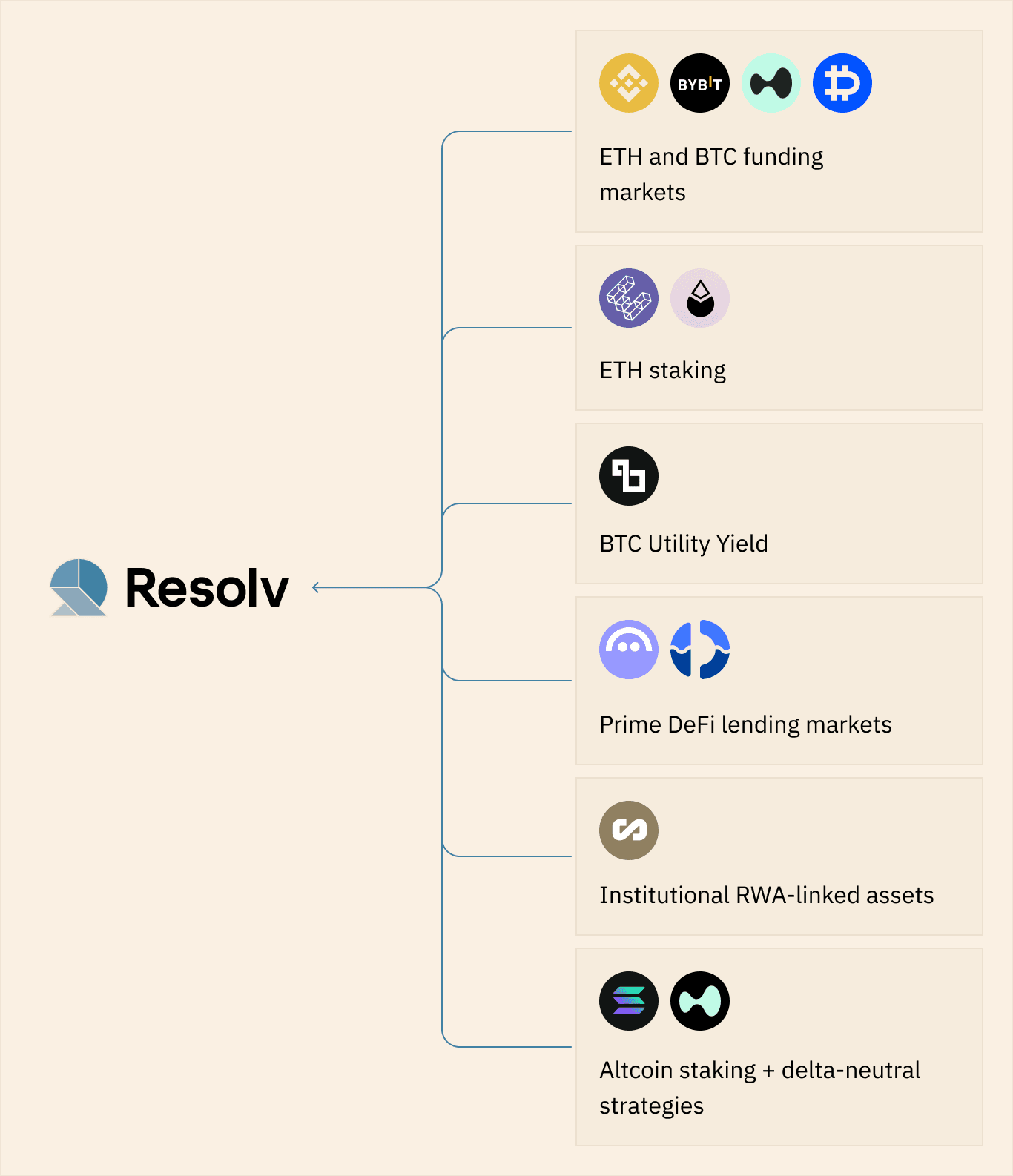

Resolv now sources yield from a diversified stack:

Resolv offers one of the most diversified sets of prime, liquid, crypto-native money markets — wrapped in a risk-conscious, overcollateralized framework.

USR is positioned as a prime stablecoin asset with a best-in-class risk profile.

RLP operates as a liquid insurance layer that captures enhanced returns while maintaining system stability.

This architecture sets a high bar for risk-adjusted yield infrastructure as we move into 2026.

Resolv is adding a new yield source by connecting to altcoin markets, starting with HYPE and SOL. These positions are fully hedged using futures on Binance and Hyperliquid, keeping the system delta-neutral while accessing attractive funding and staking rewards available in altcoin ecosystems.

With expected neutral yields in the 10–15% range and moderate allocation not exceeding 10% of the collateral pool, this integration is expected to increase overall returns by approximately 5–10%, depending on market conditions.

This expands Resolv’s coverage of the crypto yield landscape and improves integration with fast-growing ecosystems, without changing the protocol’s risk discipline: USR remains a stable, conservative product, and RLP continues to take leveraged exposure in exchange for higher returns.

State of altcoin money markets

Over the past year, native staking and liquid staking tokens (LSTs) in altcoin ecosystems have truly taken off. Across Solana and Hyperliquid, the LSTs are forming approximately 50% of total value in DeFi.

Additionally, non-DeFi assets like XRP are increasingly being reinvested into DeFi to gain utility yields. This restaking trend is turning altcoin ecosystems into fertile ground for stable, neutral-yield opportunities.

We are also witnessing deeper funding rates on altcoin futures and greater accessibility to these markets for professional trading firms and funds. In other words, altcoin money markets are no longer niche or speculative. They are becoming a structured, narrative-driven segment of the market that can be tapped for stable returns.

Launching the Altcoin Cluster: HYPE and SOL as Initial Assets

Resolv is now connected to altcoin markets through a dedicated delta-neutral cluster.

The first assets in scope:

HYPE

SOL

Selection criteria were practical: competitive performance, liquidity depth on derivative markets, available staking infrastructure, vast ecosystem. Hedging and position management will run on:

Hyperliquid

Binance

Both venues offer the liquidity required for tight hedges and predictable funding capture. The cluster runs fully hedged and conservatively collateralized, same as for ETH and BTC positions.

Strategic Capabilities Enabled

~0.6% increase of the collateral pool APR with a 10% allocation to the Altcoin Cluster.

Accessing Bullish Altcoin Money Markets

Altcoin funding markets frequently experience yield spikes driven by narratives, network launches, TGEs, or ecosystem-specific events. These create pockets of elevated funding rates that are ideal for delta-neutral strategies.

Resolv can now systematically capture and commoditize these event-driven yield opportunities and pass them through to users — without taking directional risk.

Partnerships Around Native Staking & Altcoin LSTs

Many ecosystems need reliable, hedged demand for their staked assets. The Altcoin Cluster allows Resolv to act as an infrastructure-level allocator for these networks.

It also enables new integrations with:

staking providers

altcoin LST products

ecosystem treasury tools

In practice, Resolv provides a way to stablecoinize altcoin staking yield, turning volatile native token flows into stable, risk-adjusted yield streams. This expands utility for altcoin ecosystems and broadens their integration surface.

Deeper Alignment With Fast-Growing Ecosystems

By deploying hedged assets into staking and providing liquidity to relevant markets, Resolv contributes to altcoin markets in a measurable way.

More importantly, this expands Resolv’s integration roadmap:

Resolv is already live on HyperEVM and HyperCore.

Future integrations in our roadmap include networks such as Solana, AVAX, and others where native assets can be invested through delta-neutral mechanisms.

Over time, this creates a holistic loop: ecosystems gain access to a stablecoin that invests in their assets, strengthening both sides.

Resolv’s presence becomes embedded, not external.

Strengthened Risk Management

The altcoin expansion builds on an upgraded risk framework introduced after the 10 October event, when markets experienced broad, synchronized liquidations.

For the altcoin cluster, Resolv implemented:

Volatility-responsive margin thresholds (more conservative than ETH/BTC).

ADL mitigation mechanisms to reduce exposure to forced deleveraging cascades.

These updates make the system more resilient to the higher variance and sudden price dislocations typical of altcoin markets.

Expected Impact on Yield & Allocation Approach

1. Allocation

Initial allocation capped at 10%.

Scale-up will occur only after observing stable cluster behavior and venue liquidity.

This communicates a clear allocation guideline and demonstrates that Resolv is not taking aggressive positioning.

2. Expected Performance Impact

Historically, altcoin delta-neutral yields (funding + staking) have ranged between 10–15%.

This expansion diversifies yield sources and strengthens the core product without materially increasing the system’s risk surface. RLP continues to absorb first-loss risk as designed, allowing USR to maintain its high-confidence stability profile.

Closing the 2025 Product Cycle

With the Altcoin Cluster release, Resolv completes its 2025 development cycle and enters 2026 with a fully diversified yield engine.

Resolv now sources yield from a diversified stack:

Resolv offers one of the most diversified sets of prime, liquid, crypto-native money markets — wrapped in a risk-conscious, overcollateralized framework.

USR is positioned as a prime stablecoin asset with a best-in-class risk profile.

RLP operates as a liquid insurance layer that captures enhanced returns while maintaining system stability.

This architecture sets a high bar for risk-adjusted yield infrastructure as we move into 2026.