Resolv 2026 Roadmap

Feb 3, 2026

Throughout 2025, Resolv built the foundational infrastructure required to deliver best-in-class performance at scale.

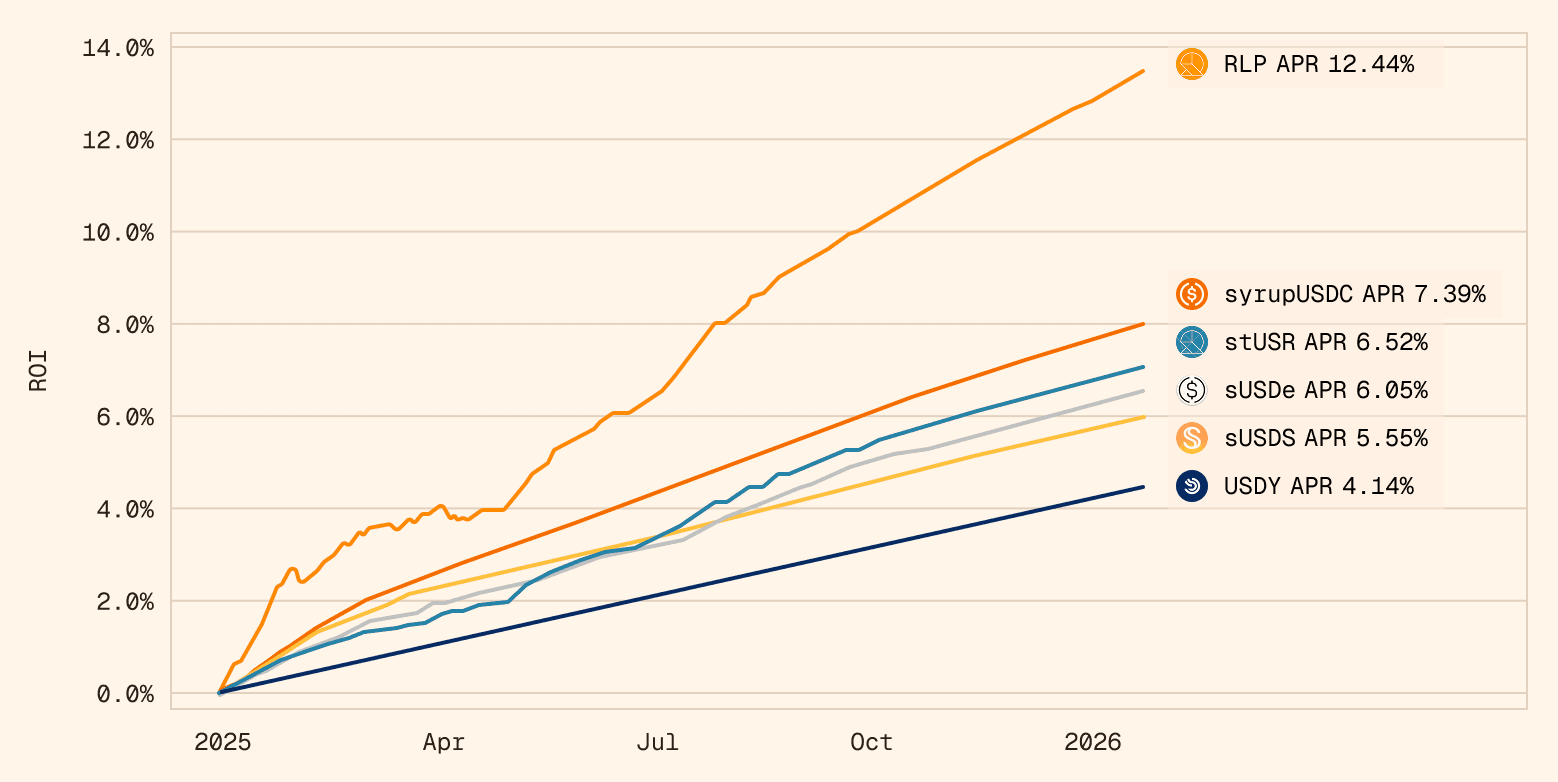

We implemented integrations across multiple money markets and yield sources, spanning DeFi lending, delta-neutral trading strategies, and real-world assets. This enabled a unified allocation framework capable of operating across different market regimes while maintaining a conservative risk profile.

By the end of the year, this framework crystallized into four core asset clusters within Resolv’s collateral pool:

Delta-neutral ETH / BTC: Historically the first core yield source, combining liquid crypto assets with hedging via perpetual markets to generate stable, market-neutral yield at scale.

USD DeFi Allocations: Dollar-denominated DeFi lending and money-market exposure, providing onchain liquidity and predictable base yield.

Delta-neutral altcoins: Higher-yield opportunities expressed through delta-neutral structures, with explicit sizing and risk limits to manage volatility and tail risk.

Real-world assets (RWAs): Early-stage integration of off-chain yield sources, introducing non-crypto risk drivers and improving portfolio diversification.

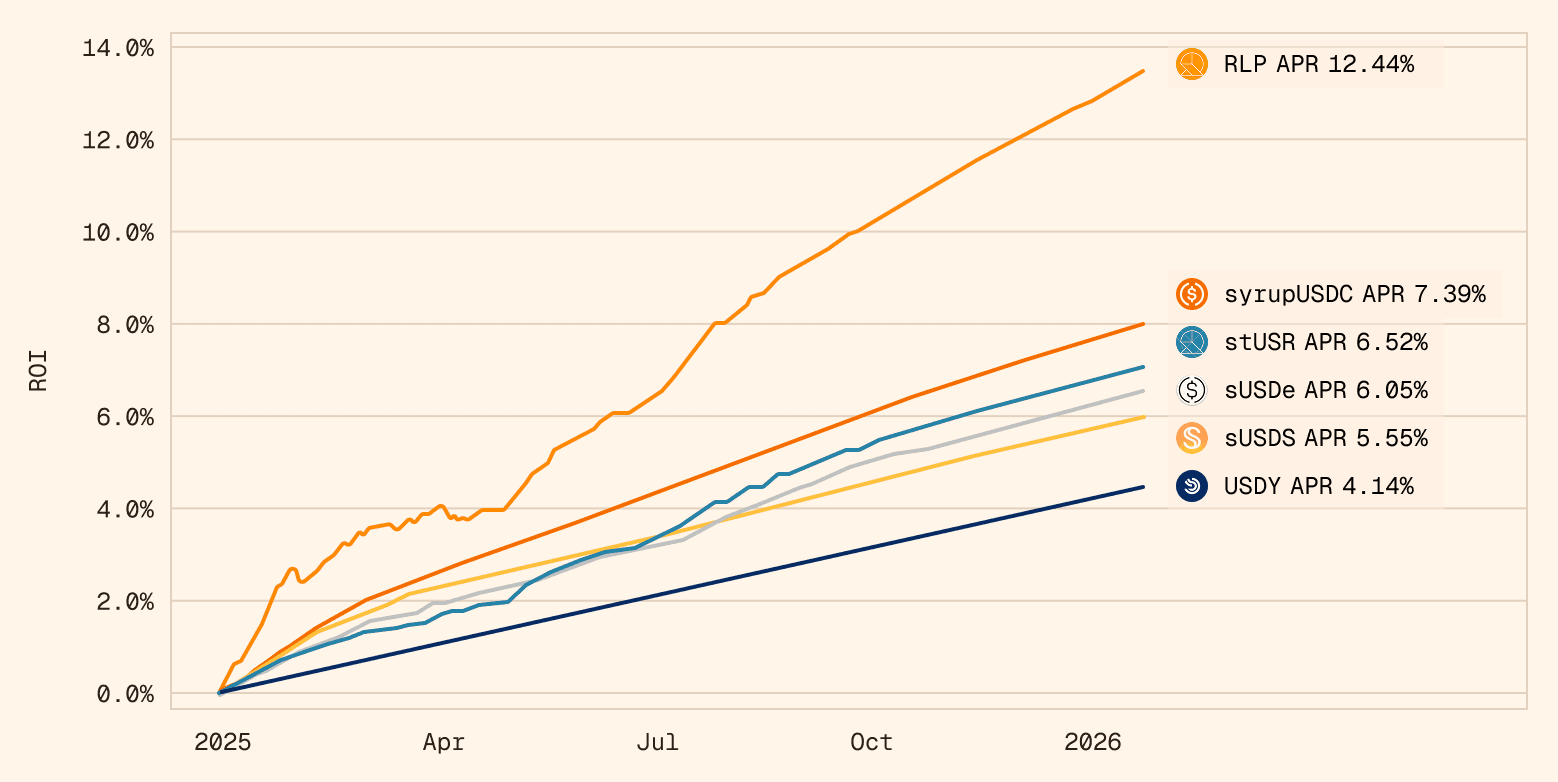

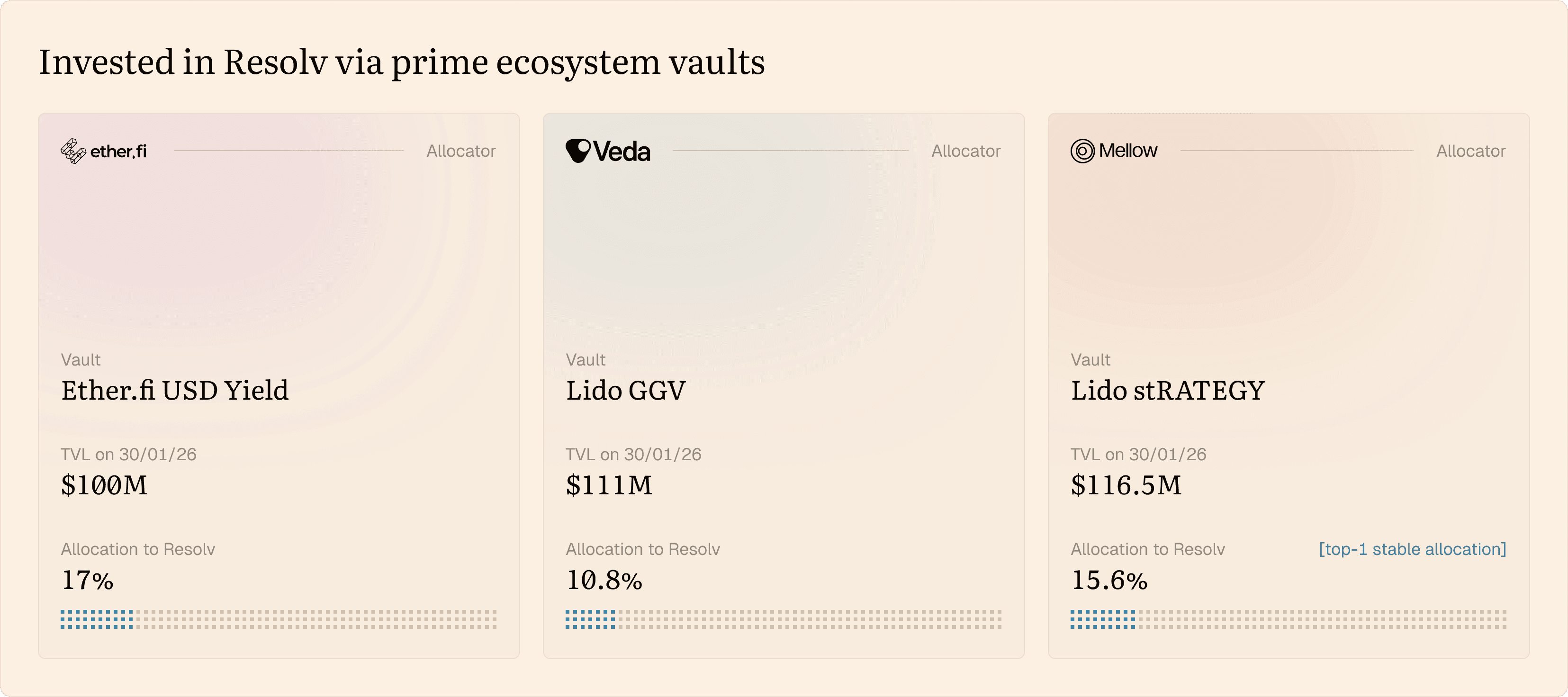

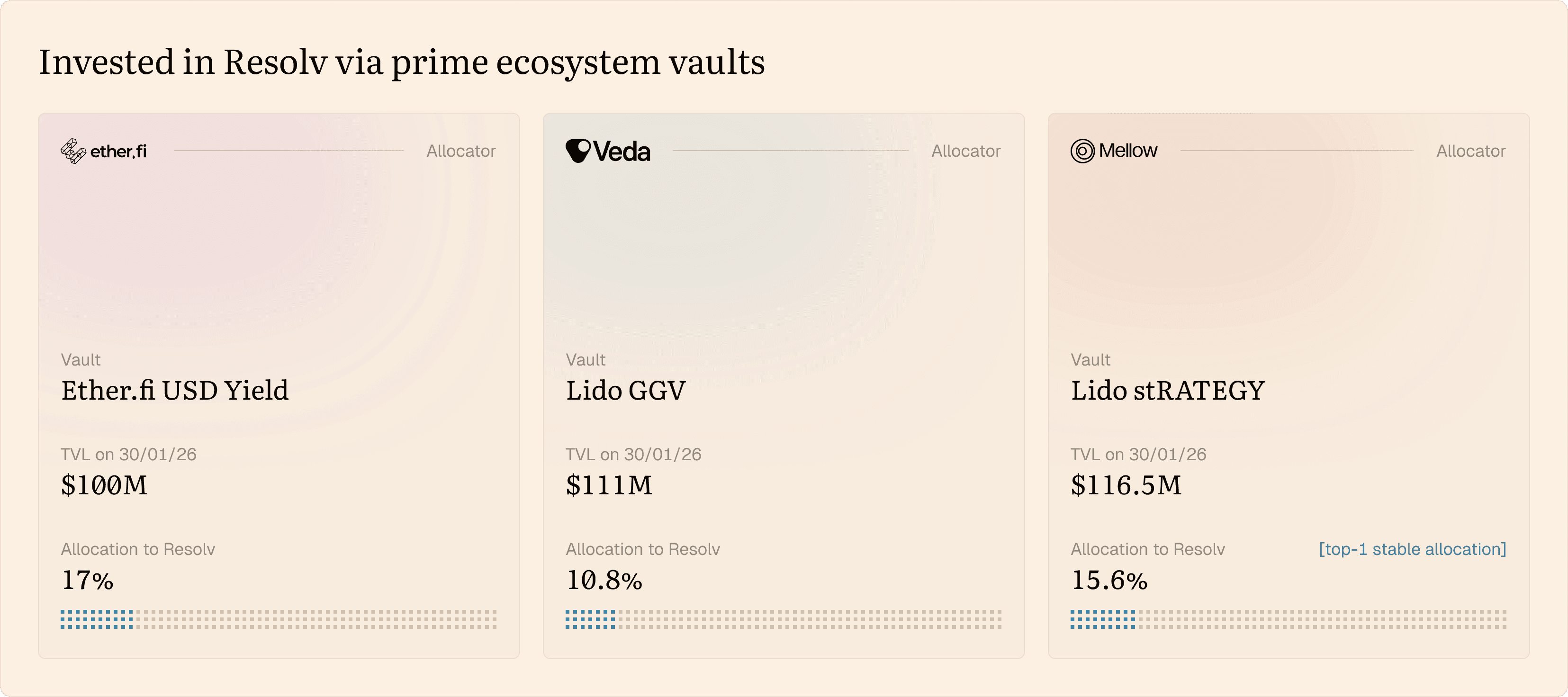

Together, these clusters served as a proof of concept for disciplined, multi-source allocation across risk profiles. Resolv delivered strong performance while maintaining conservative risk controls — robust enough that institutional participants could sustain large-scale allocations with confidence. This was highlighted by participation from institutional-grade vaults and protocols, including Lido and Ether.fi, validating Resolv’s risk framework and operational standards in production.

This foundation enables the next step in 2026: evolving Resolv from a high-performing allocation engine into prime-grade financial infrastructure.

North Star: Become a Prime-Asset for Institutional Growth

Resolv’s primary objective for 2026 is sustained TVL growth at institutional scale.

Not transient inflows driven by short-term incentives, but durable capital that can be deployed at size, remain resilient across market cycles, and be used across the crypto financial stack. Every element of the roadmap is designed as a direct lever toward that outcome.

In practice, this means focusing on two growth engines:

Establishing USR as a prime asset

Expanding Resolv as stablecoin-as-a-service infrastructure

Establishing USR as a Prime Asset

The most important question institutions ask isn’t “what’s the yield?” — it’s “why should we trust this at scale?”

In 2026, our focus is evolving Resolv from a high-performing DeFi product into prime-grade financial infrastructure.

What “prime” means in practice:

Diversified and stable yield sources

Explicit risk framework

Operational resilience and predictable behavior under stress

Diversified yield sources

Establishing Resolv as prime infrastructure raises the next question:

How do we scale allocations in a diversified, resilient way?

Our answer is to tap into a diversified real-world asset universe — powered by crypto-native money markets for capital efficiency, liquidity, and hedging.

Fixed income: RWA meets onchain markets

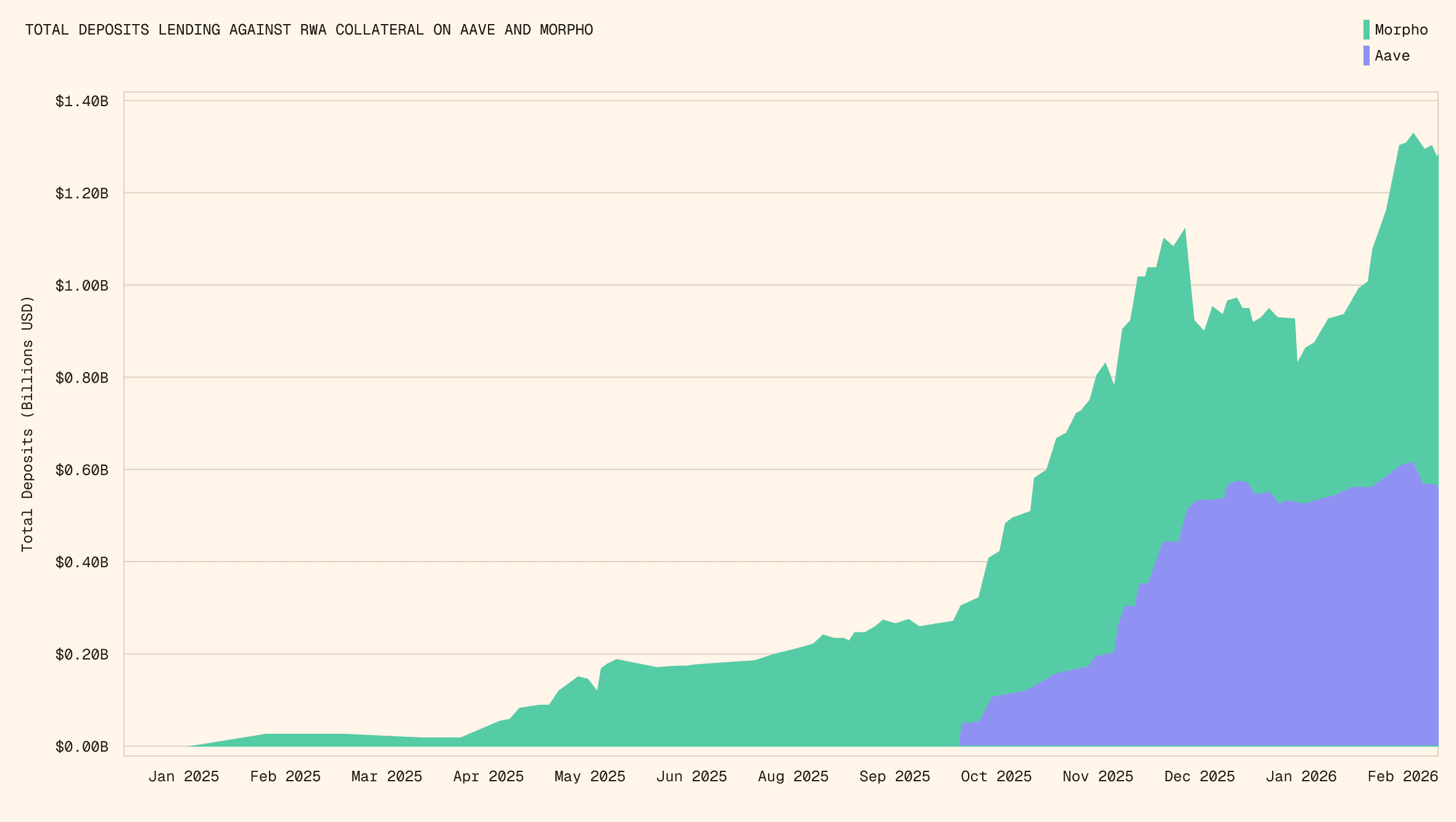

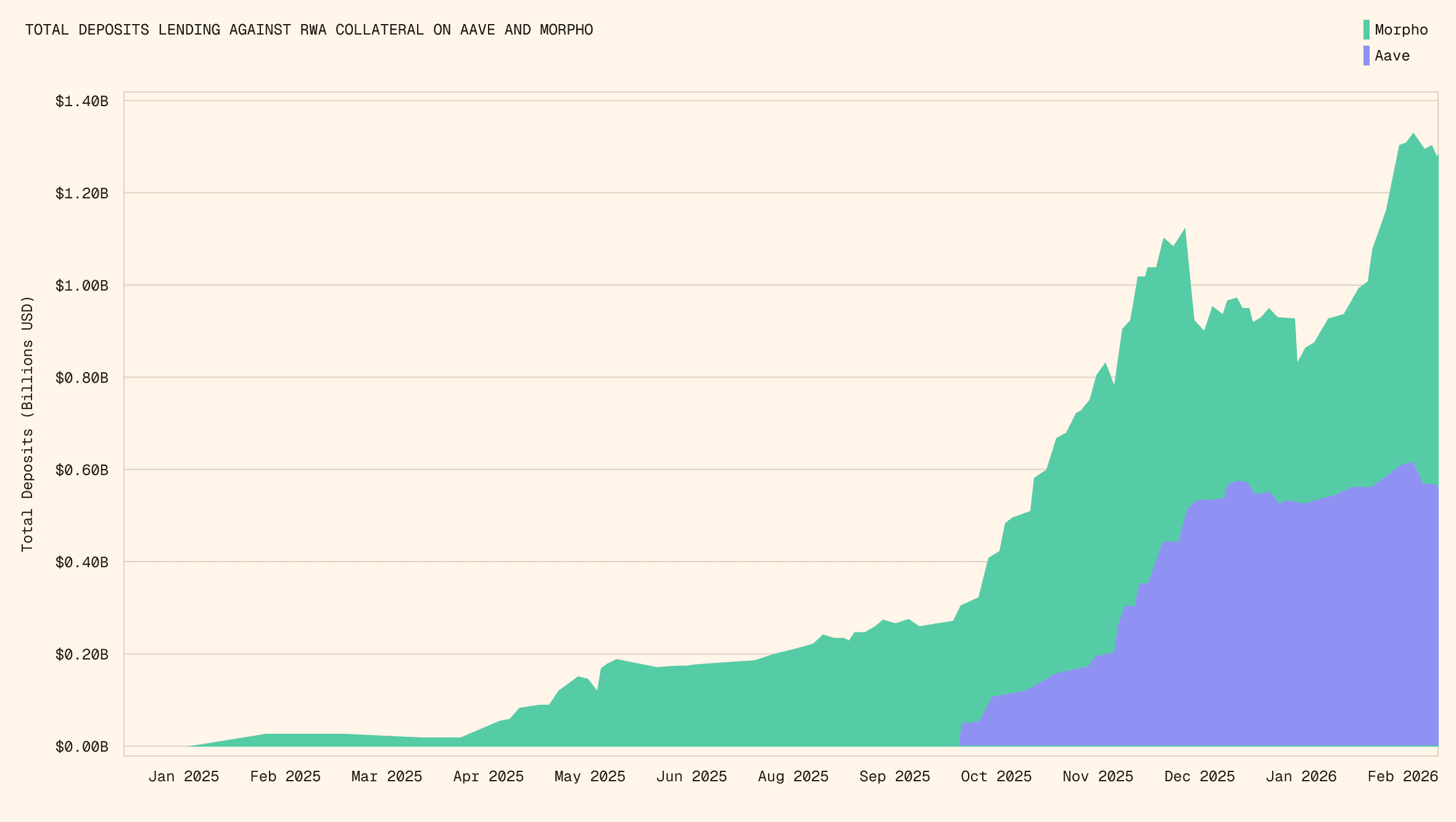

Lending against RWA collateral on venues such as Aave and Morpho has scaled from negligible levels at the start of 2025 to well over $1B in active deposits — it reflects real demand for using tokenized fixed income as a base layer for leverage, liquidity, and capital efficiency onchain.

Resolv has already integrated USCC, a Superstate’s crypto-carry fund, as foundational RWA exposure. Starting in Q1 2026, we plan to expand allocations into additional investment-grade tokenized funds, with a systematic rollout across investment-grade RWAs throughout the year.

Resolv’s role goes beyond integrating existing RWA products.

It will act as a primary underwriting participant in the value chain, actively sourcing allocable investment opportunities across traditional finance and leading their transition into onchain markets.

This includes:

leading due diligence and underwriting of underlying assets

supporting tokenization and onchain representation

enabling RWA use within DeFi lending and money markets

By combining underwriting capability with crypto-native liquidity and risk frameworks, Resolv is positioned to lead the DeFi expansion of real-world fixed income.

Delta-neutral equities and commodities

Resolv is bullish on the continued penetration of equities and commodities into onchain derivatives markets.

As these markets mature, Resolv’s infrastructure allows exposure to traditional assets through delta-neutral strategies, using onchain derivatives venues for hedging and liquidity.

In 2026, Resolv plans to actively expand into delta-neutral backing in:

gold and other commodities

equity indices

select single-name equities

These instruments are evaluated not for directional exposure, but for their ability to diversify yield sources and strengthen risk-adjusted performance within delta-neutral frameworks.

By combining traditional asset exposure with crypto-native derivatives markets, Resolv extends its delta-neutral playbook beyond crypto, while retaining the transparency, liquidity, and continuous pricing unique to onchain markets.

💬 As Resolv expands into real-world assets, we welcome dialogue with institutional participants, issuers of leading fixed-income instruments, potential underwriters, and onchain lending venues.

Our goal is to coordinate efforts across traditional and onchain finance to build durable bridges between global asset markets and DeFi liquidity.

Evolving Risk Framework with External Observability

In 2025, Resolv established a robust internal risk framework covering asset underwriting, sizing, parameter updates, and exposure limits.

In 2026, we build on this foundation by introducing greater observability and transparency into the decision-making loop. The objective is to make Resolv’s risk posture easier to understand, assess, and reason about, as a feature built for integrators, partners, and capital allocators.

This includes clearer articulation of:

tested underwriting logic and assumptions

parameter updates and risk limits

capital allocation decisions (exposure caps, concentration)

As part of this evolution, we also plan to incorporate external risk expertise to review, advise, and challenge elements of the framework as new integrations and asset classes are introduced. This external input complements internal decision-making, adding an additional layer of perspective and accountability as the system scales.

The result is a risk framework that remains disciplined and opinionated, while becoming increasingly transparent.

Operational resilience as a baseline

Throughout 2025, integrators and institutional allocators performing due diligence on Resolv consistently highlighted the protocol’s high standards across:

smart contract design

infrastructure architecture

operational resilience

In 2026, as Resolv’s footprint and integrations expand, we continue to apply these same standards, and raise them further where needed. The objective is not just to meet expectations, but to ensure Resolv remains ahead of the curve as infrastructure complexity increases.

Prime standards unlock capital access

Establishing Resolv as prime infrastructure matters most in one context: capital access.

For institutional allocators, prime status is not defined by yield alone. It is earned through a combination of robust risk frameworks and operational discipline.

Together, these elements are what allow Resolv assets to be accepted, curated, and scaled across lending markets with strict risk mandates.

In 2026, Resolv will continue expanding across lending markets, with a focus on liquidity venues that maintain the strictest risk and quality requirements.

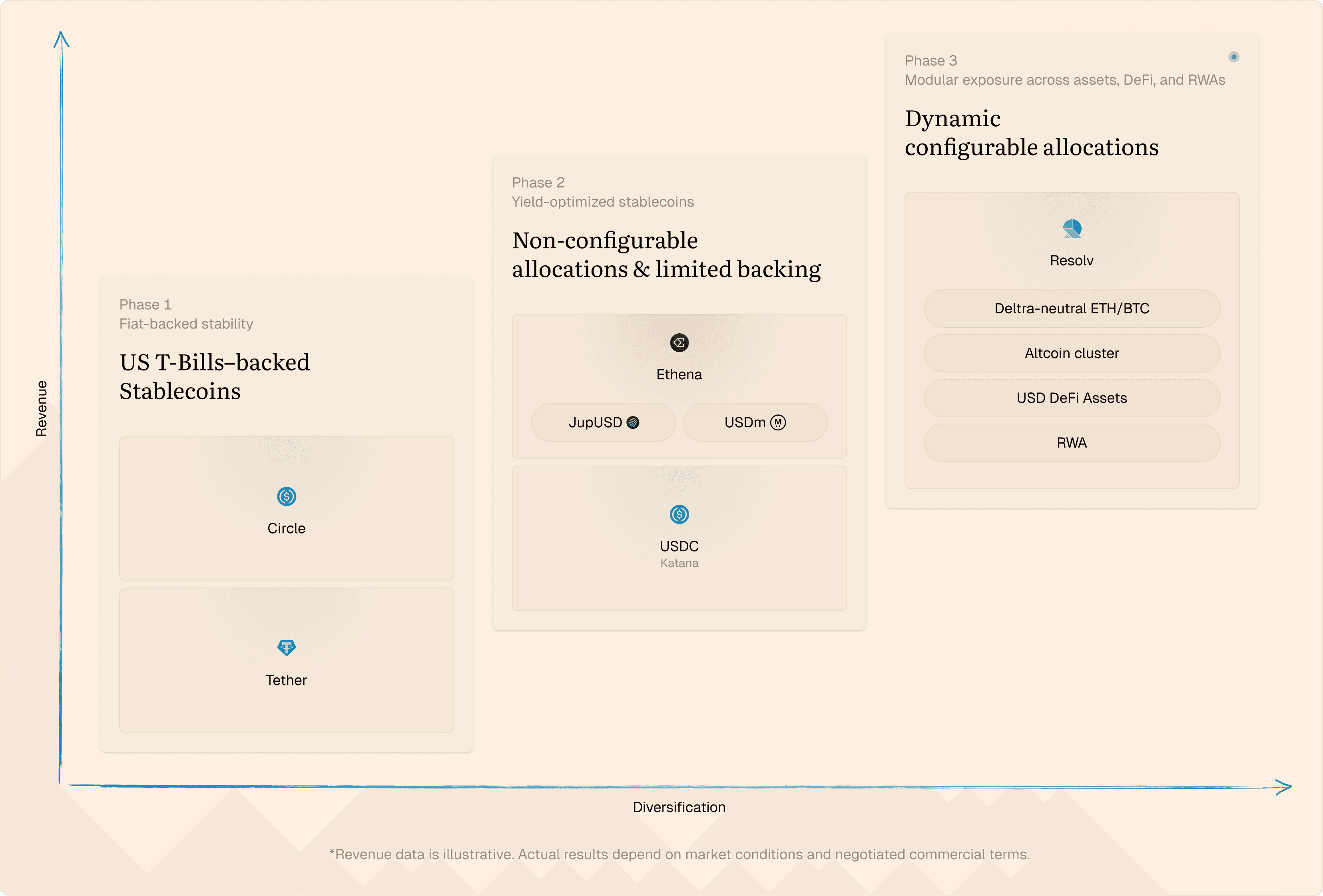

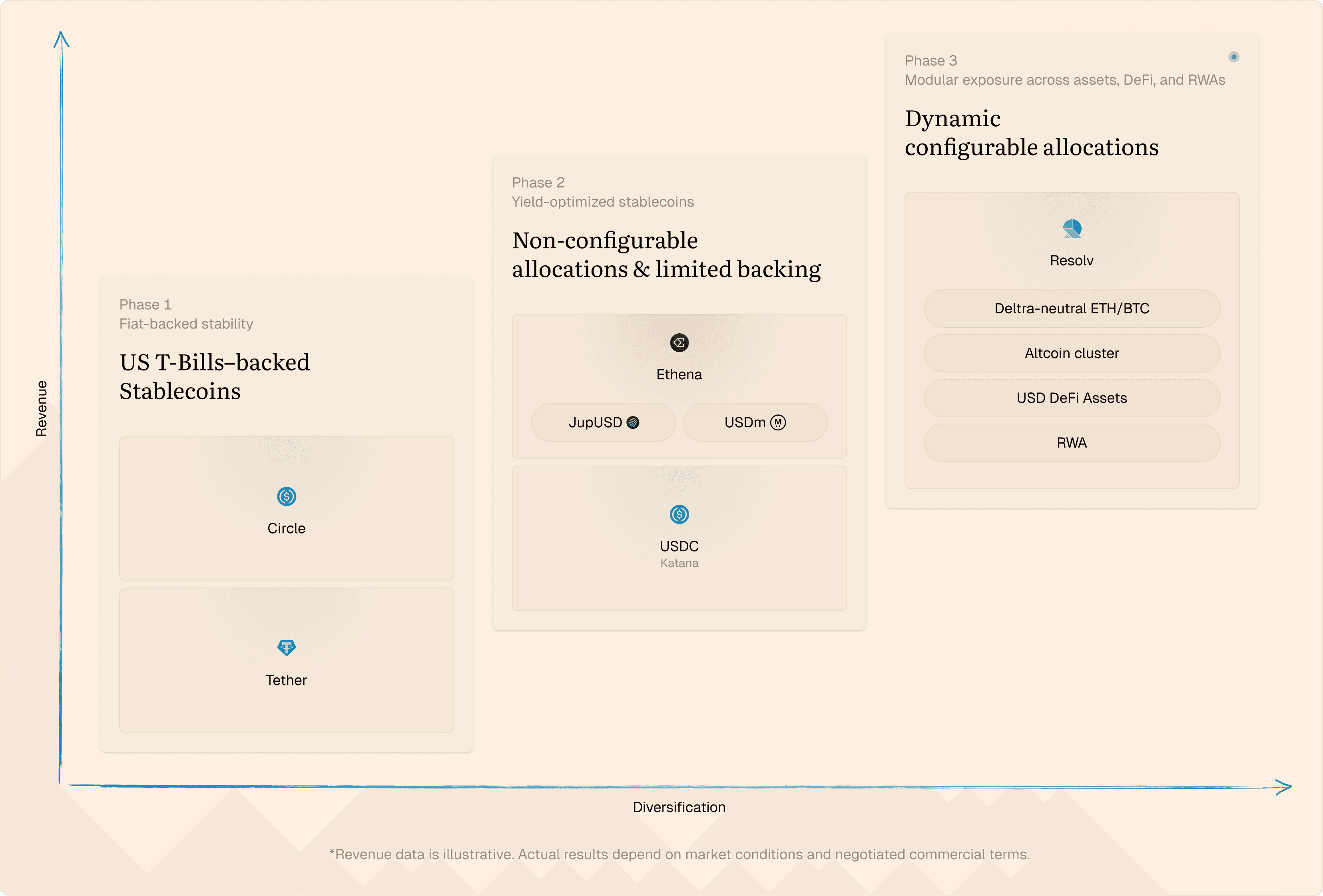

Expanding Resolv as Stablecoin-as-a-service Infrastructure

With prime-grade infrastructure and diversified allocation engines in place, Resolv offers something fundamentally differentiated: a modular, white-label infrastructure for businesses launching their own sovereign stablecoins — built on one of the widest and most battle-tested integration stacks in DeFi.

Resolv’s architecture is designed to perform across multiple market environments by natively combining:

crypto-native money markets

delta-neutral trading strategies

real-world asset exposure

cross-venue liquidity and hedging

This breadth allows partners launching on Resolv to benefit from robust, diversified performance, rather than relying on a single yield source or market condition.

Product offering

Partners building on Resolv gain access to a full-stack stablecoin infrastructure, including:

issuance and redemption rails

diversified yield allocation across multiple markets

embedded risk management and exposure limits

reporting and compliance-ready hooks

Each deployment comes with native RLP coverage, providing a built-in first-loss layer that absorbs tail risk and adverse events without requiring bespoke insurance structures.

This materially reduces time-to-market and operational complexity while preserving conservative risk characteristics.

Strategic role in Resolv’s growth

Stablecoin-as-a-service represents a second, independent growth vector alongside USR as a prime asset. This marks a shift in Resolv’s role — from a standalone protocol to a platform others build businesses on.

By offering both performance breadth and embedded risk protection, Resolv enables partners to focus on distribution and user experience, while relying on infrastructure designed for scale and durability.

💬 As Resolv expands its modular infrastructure for sovereign stablecoins, we welcome collaboration with businesses and platforms interested in building on Resolv stack.

We are particularly keen to work with teams looking to launch differentiated dollar products backed by diversified yield and native risk protection.

Revenue Generation at Scale

As Resolv scales its infrastructure and integrations, our focus in 2026 is on organic, durable revenue growth — driven by sound unit economics and long-term partnerships.

Organic revenue and positive unit economics

We prioritize revenue that is structurally aligned with protocol usage. In practice, this means ensuring positive unit economics across incentives, fee-sharing arrangements, rebates, and collaborative growth mechanisms.

Incentives are treated as investments with clear return expectations — not as substitutes for product-market fit. Our goal is to grow fee-bearing activity in a way that strengthens Resolv’s fundamentals.

Partnership-driven growth flywheel

Resolv is a strong proponent of a partnership-driven growth flywheel. In 2026, we continue to deepen and expand the collaborations initiated in 2025 with teams such as EtherFi, Fluid, and Lombard, among others.

These partnerships are designed to be mutually reinforcing — aligning incentives, expanding distribution, and creating shared upside as adoption grows.

Investor relations and transparency

As the protocol matures, we invest further in our investor relations and communications framework, including clearer reporting formats, greater transparency around performance and growth drivers, and more consistent updates for institutional stakeholders.

Our objective is to make Resolv not only easy to integrate with, but also easy to understand, evaluate, and trust as a long-term financial platform.

💬 We welcome dialogue with institutional investors and strategic partners interested in Resolv’s long-term growth, governance, and capital efficiency. As our reporting and investor communications mature in 2026, we aim to make Resolv increasingly transparent, predictable, and institution-ready.

Closing Thoughts

In 2026, Resolv evolves from a high-performing stablecoin into prime-grade, revenue-generating financial infrastructure.

One that:

institutions can trust

integrators can build on

businesses can grow with

We’re excited to keep building this — together with our users, partners, and the broader ecosystem.

Throughout 2025, Resolv built the foundational infrastructure required to deliver best-in-class performance at scale.

We implemented integrations across multiple money markets and yield sources, spanning DeFi lending, delta-neutral trading strategies, and real-world assets. This enabled a unified allocation framework capable of operating across different market regimes while maintaining a conservative risk profile.

By the end of the year, this framework crystallized into four core asset clusters within Resolv’s collateral pool:

Delta-neutral ETH / BTC: Historically the first core yield source, combining liquid crypto assets with hedging via perpetual markets to generate stable, market-neutral yield at scale.

USD DeFi Allocations: Dollar-denominated DeFi lending and money-market exposure, providing onchain liquidity and predictable base yield.

Delta-neutral altcoins: Higher-yield opportunities expressed through delta-neutral structures, with explicit sizing and risk limits to manage volatility and tail risk.

Real-world assets (RWAs): Early-stage integration of off-chain yield sources, introducing non-crypto risk drivers and improving portfolio diversification.

Together, these clusters served as a proof of concept for disciplined, multi-source allocation across risk profiles. Resolv delivered strong performance while maintaining conservative risk controls — robust enough that institutional participants could sustain large-scale allocations with confidence. This was highlighted by participation from institutional-grade vaults and protocols, including Lido and Ether.fi, validating Resolv’s risk framework and operational standards in production.

This foundation enables the next step in 2026: evolving Resolv from a high-performing allocation engine into prime-grade financial infrastructure.

North Star: Become a Prime-Asset for Institutional Growth

Resolv’s primary objective for 2026 is sustained TVL growth at institutional scale.

Not transient inflows driven by short-term incentives, but durable capital that can be deployed at size, remain resilient across market cycles, and be used across the crypto financial stack. Every element of the roadmap is designed as a direct lever toward that outcome.

In practice, this means focusing on two growth engines:

Establishing USR as a prime asset

Expanding Resolv as stablecoin-as-a-service infrastructure

Establishing USR as a Prime Asset

The most important question institutions ask isn’t “what’s the yield?” — it’s “why should we trust this at scale?”

In 2026, our focus is evolving Resolv from a high-performing DeFi product into prime-grade financial infrastructure.

What “prime” means in practice:

Diversified and stable yield sources

Explicit risk framework

Operational resilience and predictable behavior under stress

Diversified yield sources

Establishing Resolv as prime infrastructure raises the next question:

How do we scale allocations in a diversified, resilient way?

Our answer is to tap into a diversified real-world asset universe — powered by crypto-native money markets for capital efficiency, liquidity, and hedging.

Fixed income: RWA meets onchain markets

Lending against RWA collateral on venues such as Aave and Morpho has scaled from negligible levels at the start of 2025 to well over $1B in active deposits — it reflects real demand for using tokenized fixed income as a base layer for leverage, liquidity, and capital efficiency onchain.

Resolv has already integrated USCC, a Superstate’s crypto-carry fund, as foundational RWA exposure. Starting in Q1 2026, we plan to expand allocations into additional investment-grade tokenized funds, with a systematic rollout across investment-grade RWAs throughout the year.

Resolv’s role goes beyond integrating existing RWA products.

It will act as a primary underwriting participant in the value chain, actively sourcing allocable investment opportunities across traditional finance and leading their transition into onchain markets.

This includes:

leading due diligence and underwriting of underlying assets

supporting tokenization and onchain representation

enabling RWA use within DeFi lending and money markets

By combining underwriting capability with crypto-native liquidity and risk frameworks, Resolv is positioned to lead the DeFi expansion of real-world fixed income.

Delta-neutral equities and commodities

Resolv is bullish on the continued penetration of equities and commodities into onchain derivatives markets.

As these markets mature, Resolv’s infrastructure allows exposure to traditional assets through delta-neutral strategies, using onchain derivatives venues for hedging and liquidity.

In 2026, Resolv plans to actively expand into delta-neutral backing in:

gold and other commodities

equity indices

select single-name equities

These instruments are evaluated not for directional exposure, but for their ability to diversify yield sources and strengthen risk-adjusted performance within delta-neutral frameworks.

By combining traditional asset exposure with crypto-native derivatives markets, Resolv extends its delta-neutral playbook beyond crypto, while retaining the transparency, liquidity, and continuous pricing unique to onchain markets.

💬 As Resolv expands into real-world assets, we welcome dialogue with institutional participants, issuers of leading fixed-income instruments, potential underwriters, and onchain lending venues.

Our goal is to coordinate efforts across traditional and onchain finance to build durable bridges between global asset markets and DeFi liquidity.

Evolving Risk Framework with External Observability

In 2025, Resolv established a robust internal risk framework covering asset underwriting, sizing, parameter updates, and exposure limits.

In 2026, we build on this foundation by introducing greater observability and transparency into the decision-making loop. The objective is to make Resolv’s risk posture easier to understand, assess, and reason about, as a feature built for integrators, partners, and capital allocators.

This includes clearer articulation of:

tested underwriting logic and assumptions

parameter updates and risk limits

capital allocation decisions (exposure caps, concentration)

As part of this evolution, we also plan to incorporate external risk expertise to review, advise, and challenge elements of the framework as new integrations and asset classes are introduced. This external input complements internal decision-making, adding an additional layer of perspective and accountability as the system scales.

The result is a risk framework that remains disciplined and opinionated, while becoming increasingly transparent.

Operational resilience as a baseline

Throughout 2025, integrators and institutional allocators performing due diligence on Resolv consistently highlighted the protocol’s high standards across:

smart contract design

infrastructure architecture

operational resilience

In 2026, as Resolv’s footprint and integrations expand, we continue to apply these same standards, and raise them further where needed. The objective is not just to meet expectations, but to ensure Resolv remains ahead of the curve as infrastructure complexity increases.

Prime standards unlock capital access

Establishing Resolv as prime infrastructure matters most in one context: capital access.

For institutional allocators, prime status is not defined by yield alone. It is earned through a combination of robust risk frameworks and operational discipline.

Together, these elements are what allow Resolv assets to be accepted, curated, and scaled across lending markets with strict risk mandates.

In 2026, Resolv will continue expanding across lending markets, with a focus on liquidity venues that maintain the strictest risk and quality requirements.

Expanding Resolv as Stablecoin-as-a-service Infrastructure

With prime-grade infrastructure and diversified allocation engines in place, Resolv offers something fundamentally differentiated: a modular, white-label infrastructure for businesses launching their own sovereign stablecoins — built on one of the widest and most battle-tested integration stacks in DeFi.

Resolv’s architecture is designed to perform across multiple market environments by natively combining:

crypto-native money markets

delta-neutral trading strategies

real-world asset exposure

cross-venue liquidity and hedging

This breadth allows partners launching on Resolv to benefit from robust, diversified performance, rather than relying on a single yield source or market condition.

Product offering

Partners building on Resolv gain access to a full-stack stablecoin infrastructure, including:

issuance and redemption rails

diversified yield allocation across multiple markets

embedded risk management and exposure limits

reporting and compliance-ready hooks

Each deployment comes with native RLP coverage, providing a built-in first-loss layer that absorbs tail risk and adverse events without requiring bespoke insurance structures.

This materially reduces time-to-market and operational complexity while preserving conservative risk characteristics.

Strategic role in Resolv’s growth

Stablecoin-as-a-service represents a second, independent growth vector alongside USR as a prime asset. This marks a shift in Resolv’s role — from a standalone protocol to a platform others build businesses on.

By offering both performance breadth and embedded risk protection, Resolv enables partners to focus on distribution and user experience, while relying on infrastructure designed for scale and durability.

💬 As Resolv expands its modular infrastructure for sovereign stablecoins, we welcome collaboration with businesses and platforms interested in building on Resolv stack.

We are particularly keen to work with teams looking to launch differentiated dollar products backed by diversified yield and native risk protection.

Revenue Generation at Scale

As Resolv scales its infrastructure and integrations, our focus in 2026 is on organic, durable revenue growth — driven by sound unit economics and long-term partnerships.

Organic revenue and positive unit economics

We prioritize revenue that is structurally aligned with protocol usage. In practice, this means ensuring positive unit economics across incentives, fee-sharing arrangements, rebates, and collaborative growth mechanisms.

Incentives are treated as investments with clear return expectations — not as substitutes for product-market fit. Our goal is to grow fee-bearing activity in a way that strengthens Resolv’s fundamentals.

Partnership-driven growth flywheel

Resolv is a strong proponent of a partnership-driven growth flywheel. In 2026, we continue to deepen and expand the collaborations initiated in 2025 with teams such as EtherFi, Fluid, and Lombard, among others.

These partnerships are designed to be mutually reinforcing — aligning incentives, expanding distribution, and creating shared upside as adoption grows.

Investor relations and transparency

As the protocol matures, we invest further in our investor relations and communications framework, including clearer reporting formats, greater transparency around performance and growth drivers, and more consistent updates for institutional stakeholders.

Our objective is to make Resolv not only easy to integrate with, but also easy to understand, evaluate, and trust as a long-term financial platform.

💬 We welcome dialogue with institutional investors and strategic partners interested in Resolv’s long-term growth, governance, and capital efficiency. As our reporting and investor communications mature in 2026, we aim to make Resolv increasingly transparent, predictable, and institution-ready.

Closing Thoughts

In 2026, Resolv evolves from a high-performing stablecoin into prime-grade, revenue-generating financial infrastructure.

One that:

institutions can trust

integrators can build on

businesses can grow with

We’re excited to keep building this — together with our users, partners, and the broader ecosystem.